February saw stellar heights in US equities get decimated in a highly accelerated plunge that ended up wiping -12.76% off the S&P500, bringing it back down to levels not seen since early October.

Hindsight is no more helpful than wishing you could turn the clock back and relive the moment differently. So the only real question is: How do you learn from the collapse in February?

Comments such as: “Everyone knew that stocks were over-valued on Feb 19”, “it was inevitable”, “the economic threat of the coronavirus was being downplayed and ignored” (please note our commentary from last month), etc., etc., etc. These are natural, but unhelpful (verging on useless) post-event story-fitting explanations, unless of course they shape a learning experience, to inform future decisions.

As humans we do learn from our mistakes, though the extent to which we do this, can be very clouded by the pride of a dented ego. For proper human learning to occur it is necessary to be able to acknowledge both error and ignorance. The natural, non-human, world is not prone to the same interference of pride and so does, over multiple learned experiences absorb and accommodate new information from which it shapes and adapts behavior.

With Artificial Intelligence, the challenge for its proponents (of which the author is one), is to deal with experience from a data perspective as genuine learning and not retrospective story-fitting.

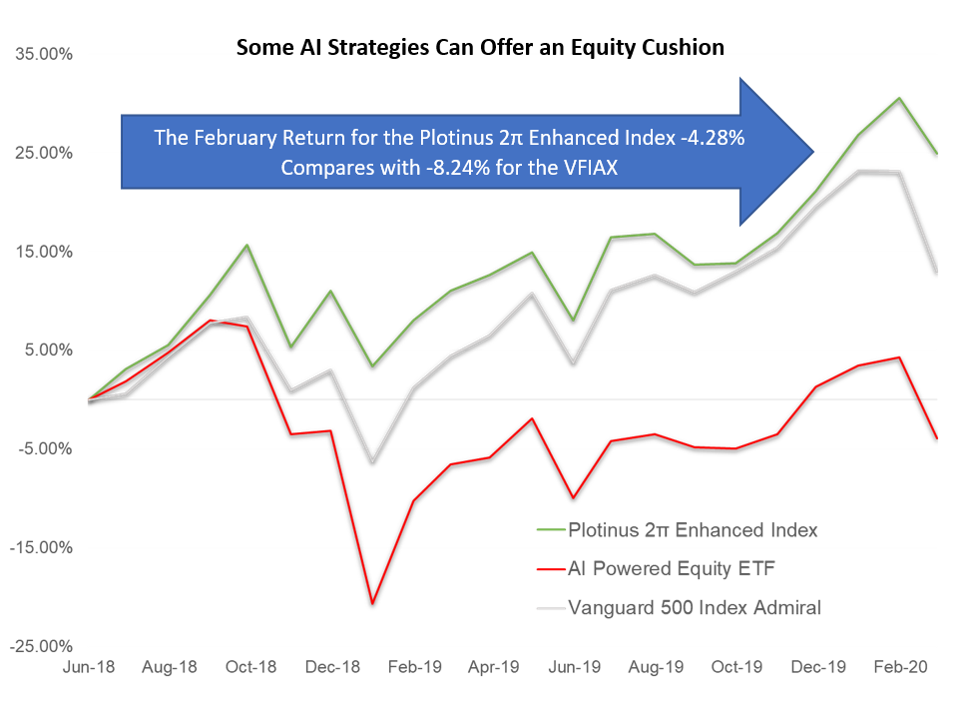

We advocate that investors take a sanguine look at their equity exposure but not respond with the common knee-jerk reaction to withdraw from equities. Seeking instead alternatives that exploit the benefits of AI technology to enable them to both de-risk to an extent from their equity exposure whilst maintaining the goals they had for their original investment.

It is important to remember that “facts” are “facts” in a context. There are different ways of constructing “facts”. For instance, according to the United Nations, since the start of the year roughly 9.4 million people have died globally, approximately 1.67 million of them in China alone. China’s official death toll from Covid-19 during that period was 2,788 or 0.16% of all deaths in China.

We dwell in a world well used to adapting to circumstance. We already live with viruses with attrition rates of 6-in-10 like Ebola, or 1-in-1000 for common flu and also with a 100% certainty of dying. Investment markets exist in the midst of these realities. Thus, regardless of how contagious or lethal Covid-19 becomes, the markets will adapt themselves to whatever stabilizes as the new reality. February’s sudden, violent correction may only be the beginning. There could be a further value purge with more pain to come but opportunities are to be found with AI strategies, in any market condition.

So rather than panic and bail from equities, perhaps now is the time to invest in an equities cushion to soften the falls. That approach will make it easier to pick up when things recover. ■

© 2020 Plotinus Asset Management LLC. All rights reserved.

Unauthorized use and/or duplication of any material on this site without written permission is prohibited.

Image Credit: Peshkov at Can Stock Photo Inc.