The residue of the Covid-19 shock to the economies of the world is extreme uncertainty. The US equities market saw a tremendous recovery in April, but this bounce back has done little to allay underlying investor fears going forward.

If anything is to have been learned from the Covid-19 experience, it is that prediction, and modeled consequences should be taken with a very large pinch of salt. With current economic predictions that range from “The worst is behind us, just look at April” to “Get ready for the Great Depression 2.0” starting to resemble an Imperial College London epidemiological guess, model. How should an investor view the equities situation?

Valuation currently has the problem of not knowing whether previous methods and benchmarks will hold in the New Norm or whether or not the New Norm will be basically the same as the old norm. With the entire mode of consumer spending being questioned, the recent implosion in oil and the future outlook for specific industry sectors such as aviation and hospitality lacking any real idea how to be gauged, what should one do?

Herd Immunity

The growth in passive equity index investment, which in our opinion is a contributory factor to the excessive volatility seen during this crisis, has a sliver lining. For those unable or unwilling to read the tea leaves for astute stock picking, perhaps herd immunity can be found in index investing. The very scale of passive equity index investing is so vast at this point, that it constitutes a proxy of US pensions of sorts, meaning that it slips into a “too big to fail” category. Consider; on top of all of the present woes in the real economy, the inherent pressure exerted by November’s election, is it likely that US equities indices will be allowed to free fall without intensive efforts to mitigate such a scenario?

Passive Is Not the Answer

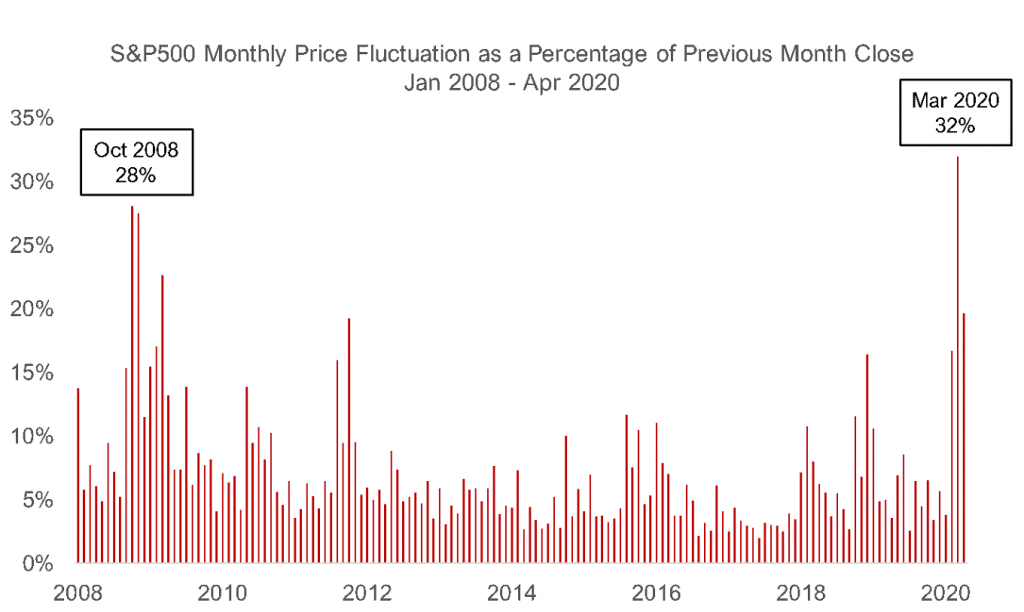

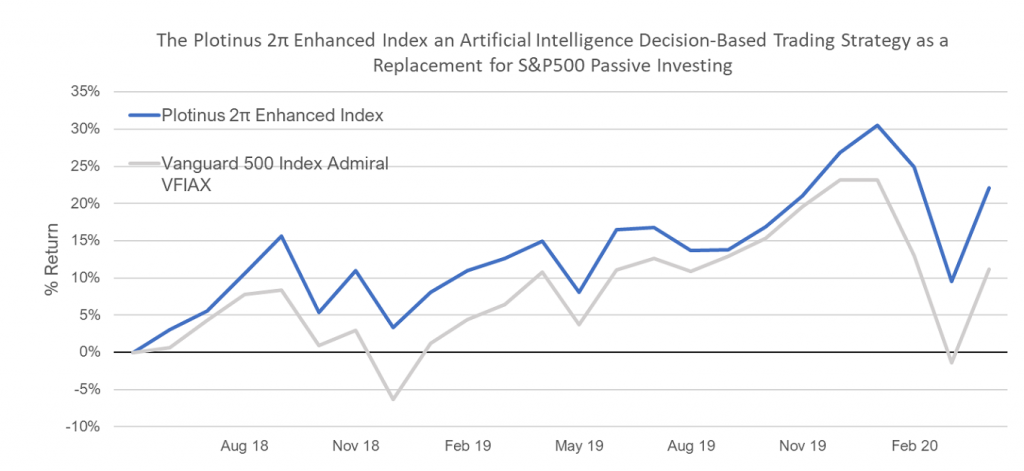

The one certainty here, if you’ll pardon the pun, is uncertainty. Uncertainty, which will by its very nature, spawn volatility. This is where the passive investing approach is not robust enough to manage that volatility. It is here that we believe there is a role for Artificial Intelligence decision-based trading.

This new active approach works to manage risk in an equities index investment. Thus, enabling the investor to take advantage of opportunity presented by the post Econovirus world by helping sail through the choppy, volatile seas of the New Normal. ■

© 2020 Plotinus Asset Management LLC. All rights reserved.

Unauthorized use and/or duplication of any material on this site without written permission is prohibited.

Image Credit: Fotococs at Can Stock Photo Inc.