As the US election makes its last twists and contortions toward its finale, there are clichés a plenty to describe its unique ‘never before, in a time like no other’ status. Partisans and pundits feast on every breath, tweet, or throat clearing from the White House.

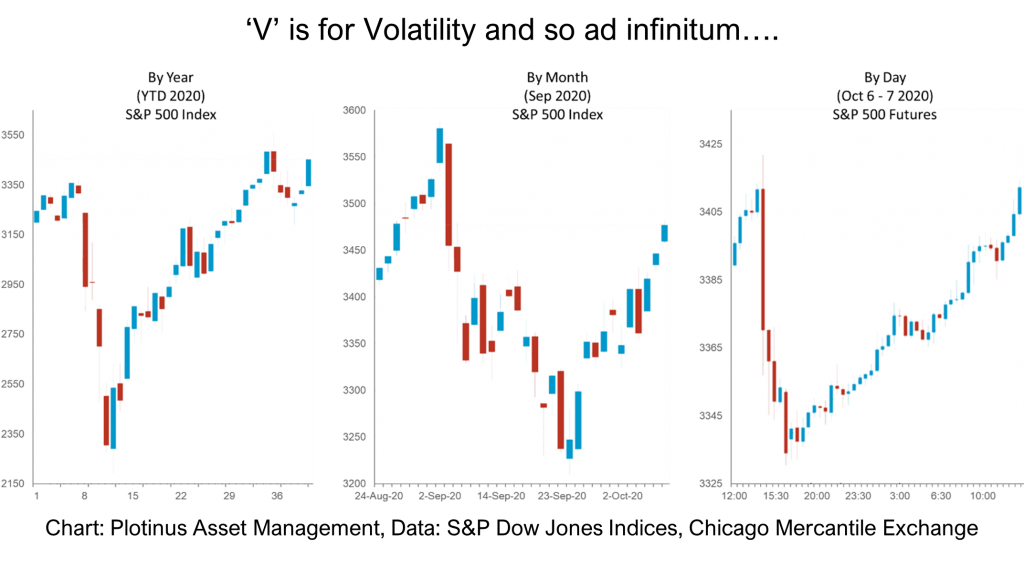

The cocktail of a sober emphasis from the Federal Reserve on the need for continued stimulus and the death by tweet of the next stimulus negotiations applied a sudden shock to the US equity market. This was soon recovered from, very much in the style of 2020.

One could be forgiven for drawing reference to Mandelbrotesque fractal patterns across both short- and long-term behavior in the US equity markets.

Volatility is back in US equity and managing that volatility is becoming key to availing of the benefits of yield that US equity can give in a post coronavirus crisis world that is low on reliable investment opportunities.

Reading the Tea Leaves

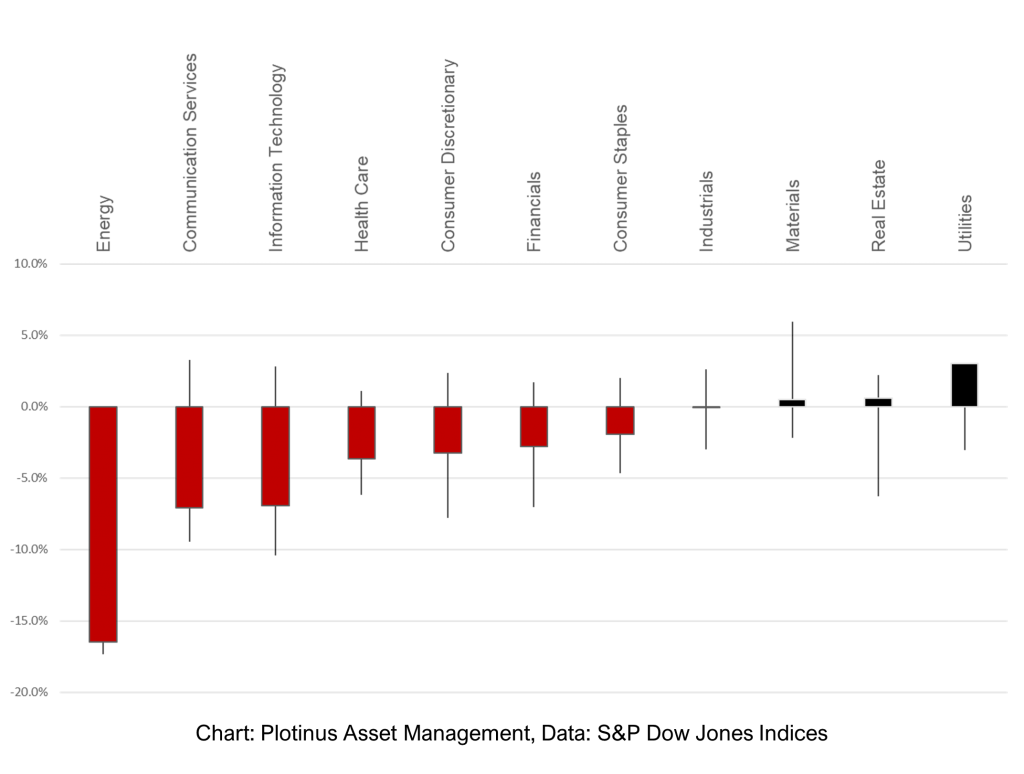

It is important not to seek out the easy generalizations to draw conclusions from the behavior of the US stock market. It is better to view some specifics that can identify areas of vulnerability, relative strength, and opportunity. Then taking this cross-spectrum into consideration, one can see the broader index-wide prospects for growth.

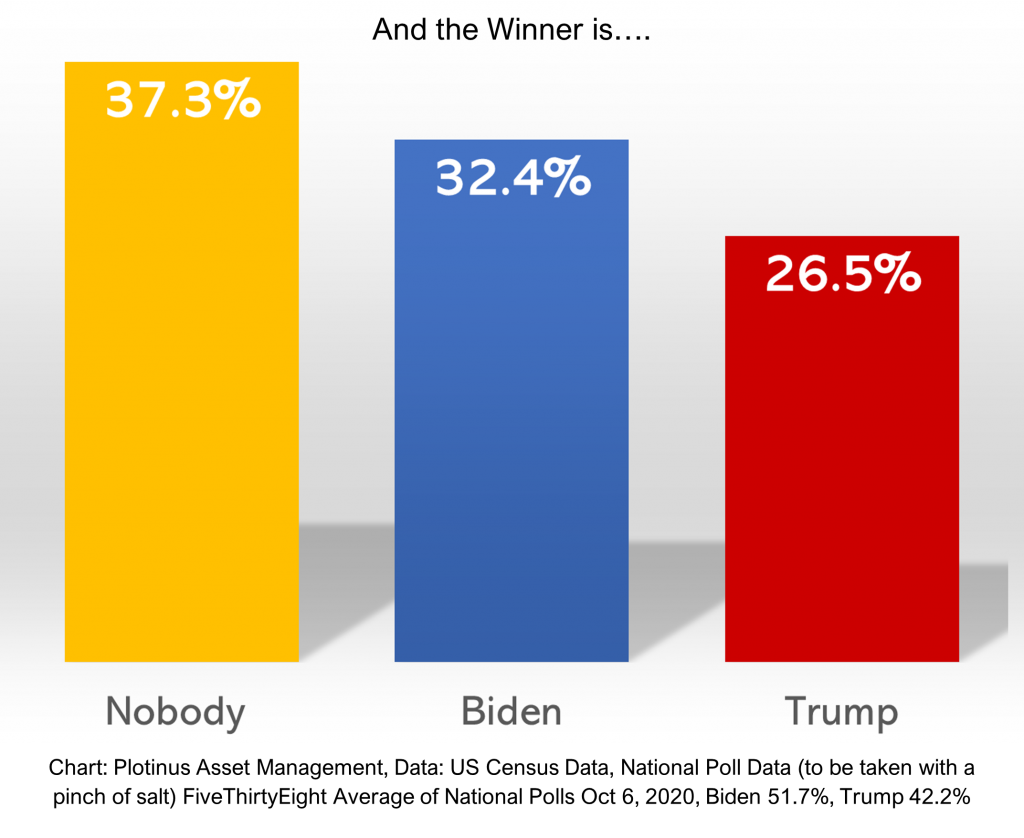

While it is tempting to view much of what is taking place through the lens of sentiment and mistakenly associate this automatically with its most convenient source of reference the media, keep in mind that many people who are fully participant in the economic activity of the nation, barely or never watch the news. We note that in the 2016 US Presidential Election more than 38% of eligible voters did not vote. This abstention rate is a strikingly similar figure to the average non-participation of 37.3% in every election since 1980.

A great sin of the data science world is “non-considered extrapolation,” where the absence of data is incorrectly assumed to mean that the present data holds true across 100% of a population. While it is often the case that such practice “might be” a fair assumption, “might be” is a conditional phrase and does not mean “is”.

As the election show reaches its climax, it is important to recognize—that for all of the partisan venom, polling, “scientific” modeling and let’s not forget data, it is more likely, based on previous elections—that the majority will by abstention vote for no President.

But as we are oft to say in the investment business, “Past Performance is not necessarily reflective of actual results”. ■

© 2020 Plotinus Asset Management. All rights reserved.

Unauthorized use and/or duplication of any material on this site without written permission is prohibited.

Image Credit: Balefire9 at Can Stock Photo Inc.