With the US presidential election now appearing to be over we are seeing much of the world’s excess media attention that the election had been vacuuming up in recent weeks, return to the theme that has dominated 2020, Covid-19. From an investor’s perspective this return to the pandemic focus means trying to continue to assess its economic/investment consequences and its various governmental mis/handlings globally.

Much had been made in the hubris of US election season of 230k deaths. While those headline grabbers may have been good for helping get the vote out for the victors, the figures are awash with footnotes and caveats and comparisons. In any case when viewed in the context of relative comparison the US weathering of the pandemic thus far, the economic setting has been much better than many other nations.

The UK for instance has stumbled into lockdown 2.0 or is it 2.1 or rather 2.2, or 2.2.1 or for at least some of the UK or all of it to a certain extent… with a raft of quasi local lockdowns, curfews, semi closures. Amid all the confusion this has created, Brexit (less we forget the topic that devoured that excess media attention for the previous three and a half years prior to the coronavirus) still remains worthy of a Shakespearean melodrama, looming menacingly in the background of all UK oriented investment planning.

In short, things for the UK look currently look bleak with its economy predicted to contract by 10.3% in 2020, according to recent European Commission estimates. The next phase of coronavirus measures have heralded a return to the government furlough scheme for workers and the Bank of England has stepped in with its second stimulus package worth GBP 150 billion. The degree of uncertainty surrounding, 2021 particularly its first quarter, leaves it a very difficult situation to predict.

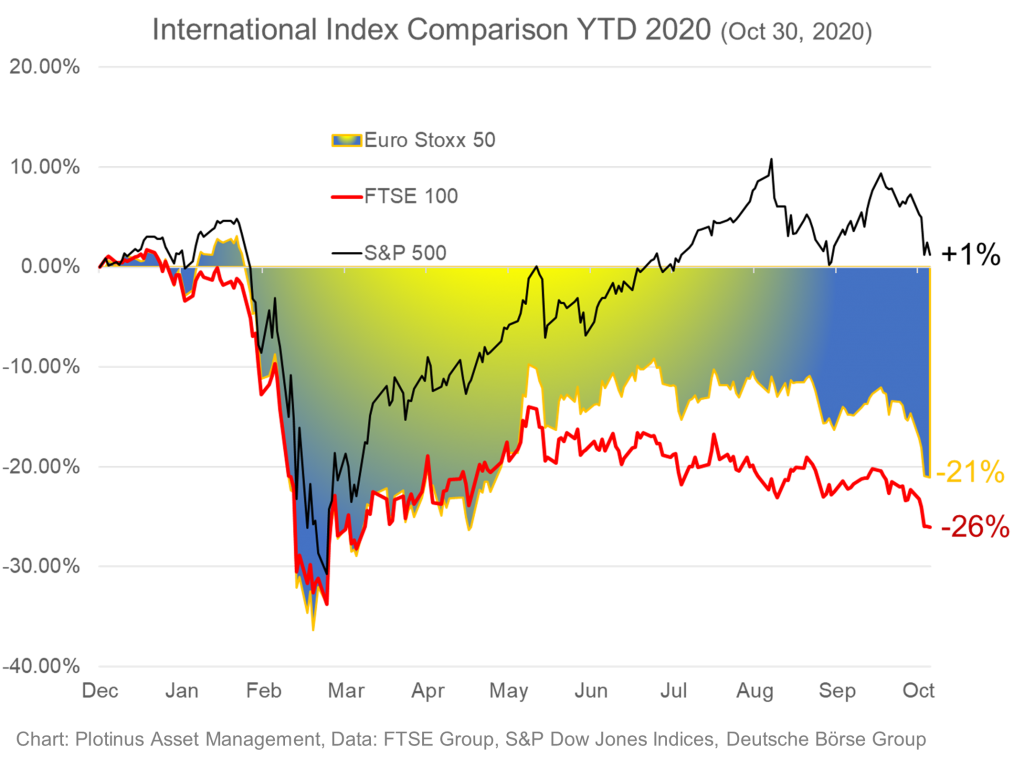

From an equity market perspective, take a look at the FTSE 100.

When compared with the S&P 500, there is shocking underperformance. This relationship is something perhaps one might argue is more reflective of the overall robustness of the US economy before the pandemic and thus not a fair comparison.

On the other hand, however, given the current difficulties of many emerging markets and the unattractiveness of much of fixed income, there is a flight of capital to international equity index investing in the search for yield. Thus, as a preeminent international equity index, the comparison between the S&P 500 and FTSE 100 is valid. Unfortunately, from a UK perspective, the flight of capital is unlikely to be making a stopover in London anytime soon.

Perhaps even more galling is the comparison with the Euro Stoxx 50. To be clear, the Euro Stoxx 50 reflects the harrowing year that 2020 has been for the Eurozone. That said, it ended October 5% the better of its British peer.

As we turn towards the later part of the fourth quarter and start to contemplate the year end, Black Friday (in its international variant) approaches UK ‘High Street’ retailers stricken with gloom. A sector which already dueling heavily with online retailers last year for market share now faces the prospect of being drown in the Amazon so to speak. To illustrate the seriousness of this, across the English Channel the French government sensing what was in the offing for its petit commerçants, arm-twisted Amazon into not going ahead with its planned Black Friday advertising campaign. So, for the sake of the UK economy, Boris Johnson had better hope that he does manage to ‘save Christmas’ our else he may end up getting a lot worse economically, than a bag of ashes from Santa Claus. ■

© 2020 Plotinus Asset Management. All rights reserved.

Unauthorized use and/or duplication of any material on this site without written permission is prohibited.

Image Credit: Jank1000 at Can Stock Photo Inc.