Can you invest in the market without being fully correlated to the market and eke out incremental added returns, all while shaving off some of the market’s downside volatility?

Almost all investors have some allocation to the US stock market. For many, their exposure is closest in characteristics to that of the S&P 500 Index. Of all the markets and indexes, this is the one for which information arbitrage opportunities are generally recognized as the slimmest. We believe the greatest potential for outperformance on the up and downsides, while pursuing capital preservation, is most likely to be had by seeking out investment positions that have the potential to deliver incremental risk-adjusted returns over time.

So, for their US stock market exposure, in pursuit of boosting returns over the long-term, how might investors participate in the market’s upside and mitigate some of its downside volatility? That was the question Plotinus set out to address when we began planning and building out our artificial intelligence strategy and the proprietary software constructed to run our methodology.

We devised a means to get core US equity market exposure with different characteristics. While our strategy is somewhat correlated to the S&P 500 Index, it offers a different, often better, pattern of returns on a daily basis.

Roller Coaster Markets Over Three Years

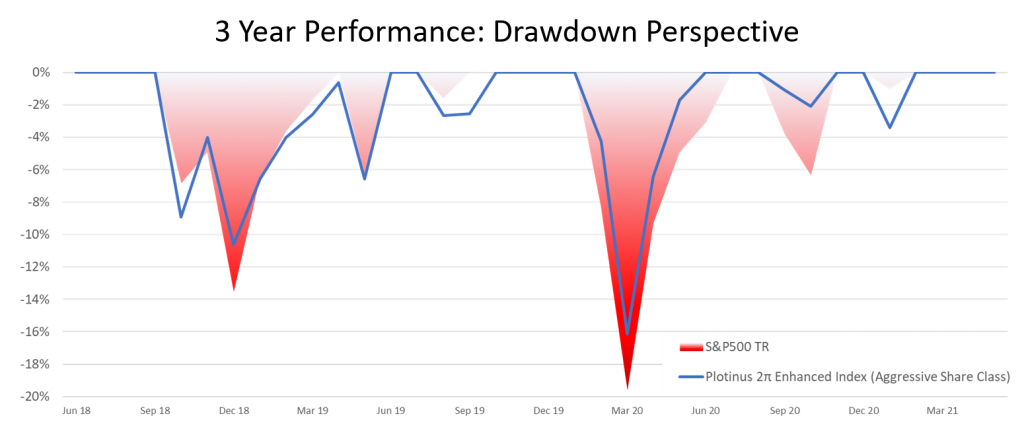

As of June 2021, we now have a three-year track record for our Plotinus 2π Enhanced Index. Our live performance over those years proved to be an important stress test for the veracity of our methodology. The market went up appreciably during that time frame. Would we be able to keep pace? When the market was hit with down-spikes in volatility how much would that impact our returns?

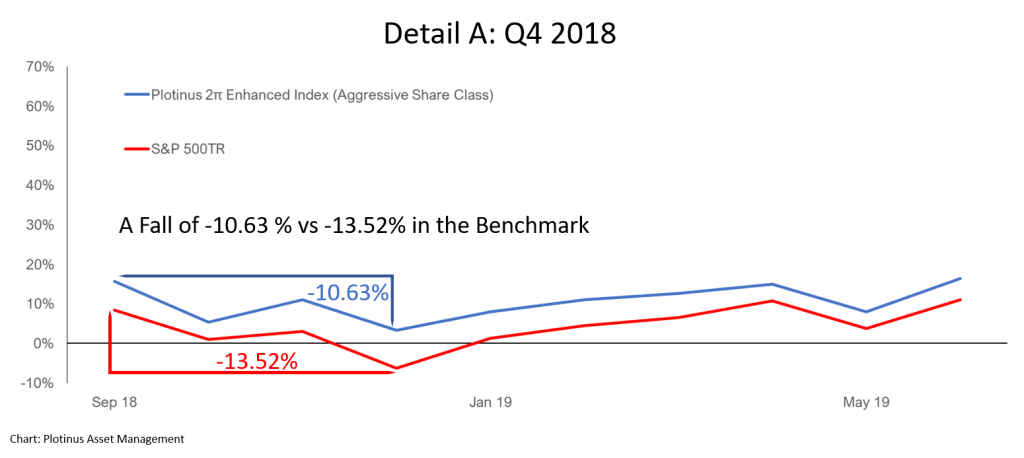

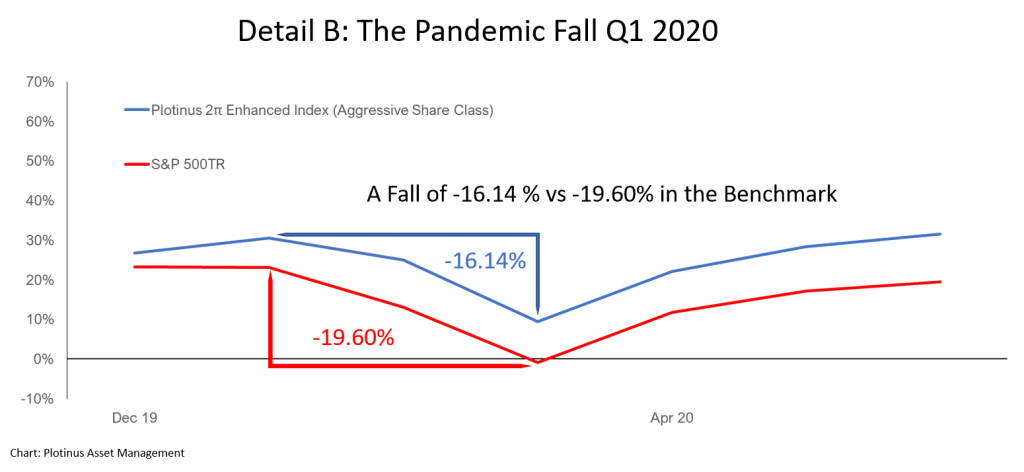

The Plotinus 2π Enhanced Index aims to mitigate some of the downside volatility experienced by the US stock market. Over the three years our strategy has been trading US stock market, investors have experienced two significant market drawdowns: Q4 2018, which resulted in more than a 13% drop in the S&P 500TR (See Detail A below) and then the much more dramatic Q1 2020 pandemic-related plunge (See Detail B below).

To put this in context, we, like you, noticed there were quite a number of strategies that were supposedly designed to provide downside protection, but experienced significant drawdowns around the start of the Covid-19 pandemic.

The better investors can manage and mitigate their exposure to downside volatility, the better job they can do in preserving capital and further growing their investments.

The underwater chart below illustrates how we performed compared to the benchmark. It is this management of downside volatility that enables our strategy to mitigate some of the downside and provide a better risk-return profile.

Shock Absorbers and Springs

This gets to the crux of what we have found. Our methodology has provided investors with US stock market exposure that offers shock absorbers against drawdown exposures and spring in the upside market recoveries.

Since its June 1, 2018 inception, the strategy has demonstrated that it can deliver lower volatility than the S&P 500 Index, while at the same time delivering outperformance.

Rethinking How to Take Your US Stock Market Exposure

Some investors will recognize that the Plotinus 2π Enhanced Index can provide a new and different way to achieve their US stock market exposure. Others may see it offers the potential to, at times, act as a hedge against their core US equities exposure. Further, used in conjunction with a passive S&P 500 Index exposure, the Plotinus strategy offers the potential to provide a more effective total return for an allocation to this core equity market holding.

Competitive Edge

Plotinus has found that there is the potential to generate derived data from the price of an investable index and from that produce better or more informed signals on which to trade. This is not from attempting to capture market inefficiencies, it is from seeking to exploit information and understanding inefficiencies. ■

© 2021 Plotinus Asset Management. All rights reserved.

Unauthorized use and/or duplication of any material on this site without written permission is prohibited.

Image Credit: Vladakela at Can Stock Photo.