January was a tumultuous month, the major US indices all posting their worst month since the pandemic fallout of March 2020 despite a last-minute claw back in the final trading days of the month. The Federal Reserve’s confirmation of its first interest rate raise since the emergency accommodation due to the pandemic, in a way could be seen to mark the end of the pandemic era for the broad US stock market. The S&P 500’s -5.3% loss alone, does not tell the whole story of January. On two separate occasions the intraday low put the index in sub -10% correction territory.

We discussed the potential for the theme of 2022 being uncertainty in our ‘AI Insight’ last month. Our contention being that investors require methods, like the use of AI trade decision-making, that embrace uncertainty rather than running from it to help manage the potential volatility of US equity investing. This uncertainty could not have been more clearly illustrated than through the violent swings that the market experienced during January. Anyone who took fright and bailed on equities, for instance, as the S&P 500 hit correction territory, was left to nurse their wounds, and reflect on the subsequent gain of circa 5% from those bottoms, 4% of which was recouped in the final two trading days of the month.

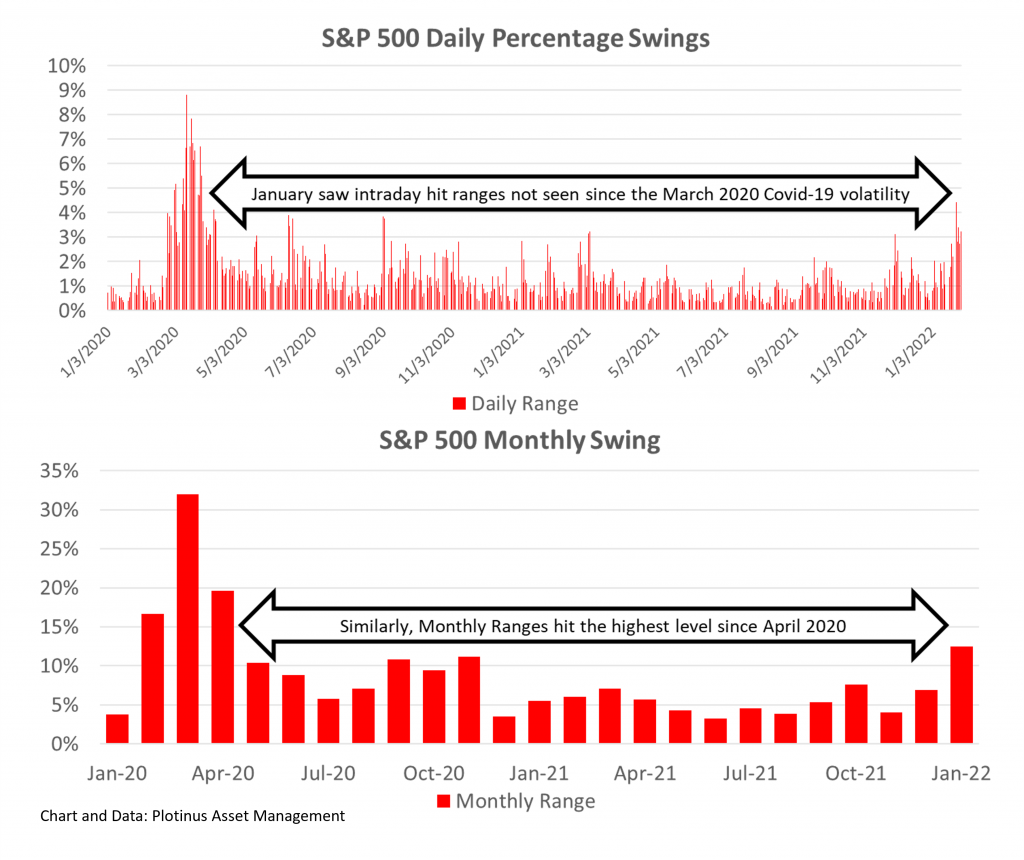

As the charts illustrate, the real story of the month was the wild swinging pendulum expressed in the range of the index at both an intraday level and the broader monthly level. This degree of erratic market behavior hasn’t been seen since the Covid Crash. So, what are the implications of such high levels of uncertainty that ultimately made the S&P 500’s -5.3% month end loss look rather palatable, when it could have been -7% or even a -10% correction?

January did not really produce any further clarity on the issues that have concerned market participants. Of course, one could say that at least now there is confirmation of forthcoming rate rises but that simply matched the broad expert consensus, which effectively meant that this shift was already being priced into the market, an assessment which in turn should have reduced not amplified uncertainty. Similarly, the inflation situation at this point is also being factored in. It clearly is and will remain a concern for all investors, but it is not surprising anyone, so should inflationary fears at this stage equate with the intense volatility we have seen in January?

To return to our recent historical context, the index swings of January are the most intense since the Covid Crash. In February and March 2020, the lack of a meaningful precedent for the market impacts of pandemic fear/threat in a highly globalized and data hyped world, presented a plethora of unknowns. This fueled the uncertainty of that time, a period which it should be noted, the US markets weathered with remarkable speed. It is important to be aware that while January’s index ranges were high, they were not of the same order of magnitude as March 2020, so we must therefore try to view what ever degree of uncertainty is currently reflected in the US stock markets contextually. Once again taking the S&P 500 as a case in point, 2021 was a year of very strong returns, and the final quarter added 40% of the year’s return. Bearing that in mind, from a certain perspective, a degree of cooling off in January is understandable.

January’s turmoil may have stimulated some investors to go hunting for uncorrelated returns, but there is of course no such thing as a free lunch. Reducing US stock market exposure may at a given time seem like a very prudent and sensible idea, but it comes with its own risks, ironically, timing, being one of the key ones. It is said that a week is a short time in politics, but the same could be said of the markets, the decisions pertaining to US stock market exposure made midway through the day on January 24 likely did not reflect the decisions one week later, on January 31. ■

© 2022 Plotinus Asset Management. All rights reserved.

Unauthorized use and/or duplication of any material on this site without written permission is prohibited.

Image Credit: Radstyle at Can Stock Photo.