The recent rate increase announcement from the Fed immediately drew in the all too familiar, historical comparison as to when the last such a rate hike occurred. Beyond the cliché of history repeating itself, just how can investors evaluate the importance of historical precedence?

When grappling with uncertainty—recognizing that investors are in the position of having to make investment decisions based on possessing incomplete information—it is natural to seek out comparisons to attempt to ground trading decisions with information that can be drawn from previous experience. This is the way most investors seek to address some of the “what if” uncertainty from “what was” at some point previously.

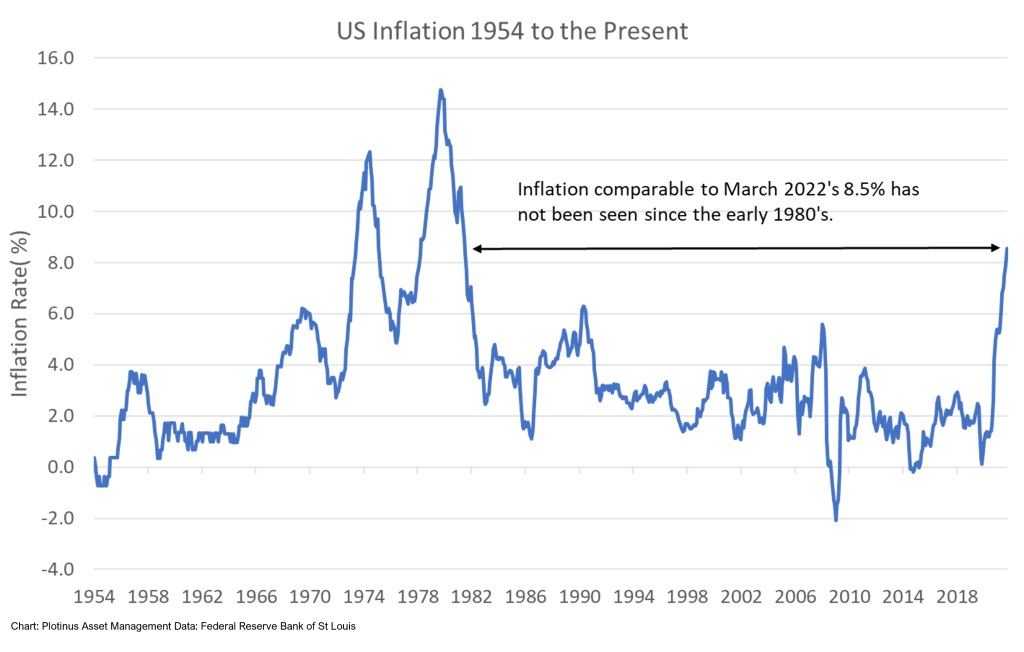

Let us explore this portfolio management challenge with reference to evaluating inflation conditions. There is, of course, historical precedence for high inflation. The last time inflation was at current levels was during the early 1980s, as can be seen from the first of the following charts.

With the exception of traders who have the benefit of actual trading experience from the early 1980s, this historical information is the data that many investors may aim to analyze, to glean whether there may be lessons to be learned from previous periods of high inflation.

Is There Value in Examining Historical Precedence?

Before answering that question, it is necessary to try to contextualize what we are looking at, or to at least be aware that failing to recognize context can have a distorting effect on the conclusions we may draw from data.

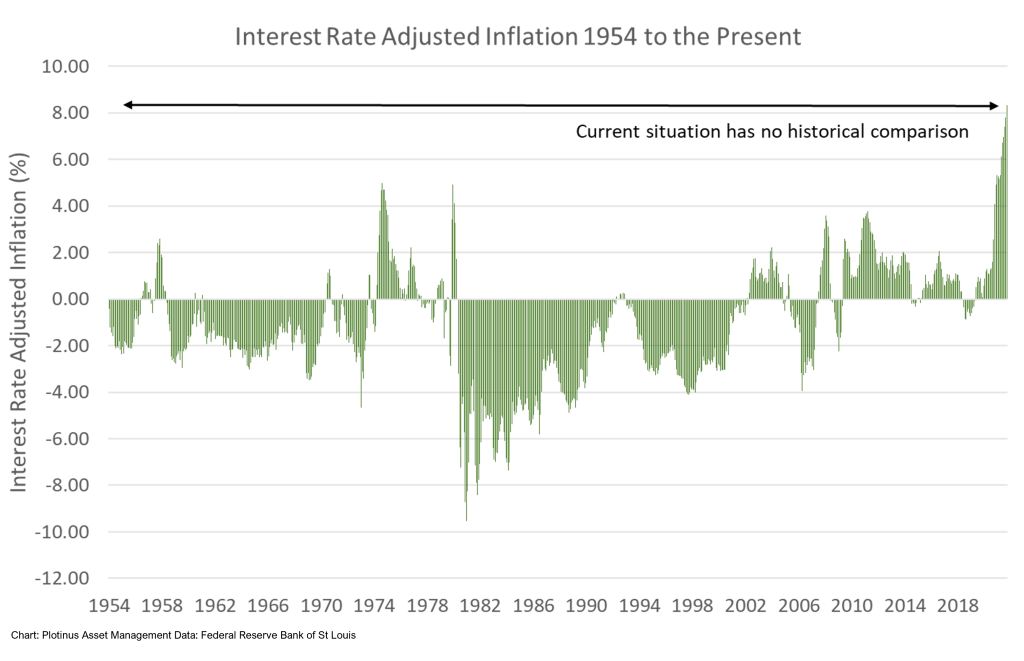

This next chart questions the premise that there that there is any historical precedence. When the data is viewed from a different, but non-complex perspective (in this case via the prism of interest rate adjustment), there is no historical comparison for the current inflation situation. This simple adjustment of the data questions the stability of making historically-based assertions.

How Might AI Address the ‘Incomplete Information’ Conundrum?

The inflation illustrations above demonstrate the importance of observing data from different perspectives. These two data charts provide us with a simplified example of the dilemmas involved in deploying AI trade decision-making; going beyond investing based on a “will history repeat itself” estimation.

To address the issue of how to deal with investment questions based on incomplete information, many artificial intelligence-based investment approaches cope with this issue by filling in for “missing” data by resorting to large quantities of alternative data and/or by repeatedly resampling the information at hand.

One of the clear advantages that an AI approach to investment decision-making can have is its ability to generate new perspectives from which to analyze data. However, this ability is not a carte-blanche invitation to simply use as much data as it can because it can. AI using big data has the potential to provide insights and correct answers, but does this equate with good money management?

There is no stability in an AI-based investment approach being correct without there also being a coherent explicable investment methodology that can illustrate why this correctness is more than fleeting happenstance.

This is the reason why we at Plotinus have chosen to use a derived data rather than a big data approach. It enables us to remain cognizant of why we are using the data we are using. Further, taking a derived data approach ensures that our system operates within its defined investment methodology, protecting it from a vulnerability of big data AI systems, which are prone to getting lost in the nebulous un-answerability of why a big data system is producing its decisions.

You will note that we are yet to answer our earlier question: Is there value in examining historical precedence? as it was quickly supplanted by: Is there historical precedence? There is however no correct answer to either question, just a relative one, which is dependent on the investment context in which this is being examined. This context dependence of investment questions is what forms such a strong argument in favor of investors, including the use of situation specific, AI trade decision-making strategies in their portfolios. ■

© 2022 Plotinus Asset Management. All rights reserved.

Unauthorized use and/or duplication of any material on this site without written permission is prohibited.

Image Credit: Maxkabakov at Can Stock Photo.