The beginning of summer has brought with it a bear market and much uncertainty with the looming prospect of a US and global recession.

The Dow and S&P 500 ended basically flat for May, but those month-end figures belied the brewing unease that was reflected in a turbulent month for the markets. For the S&P 500 to end the month flat, for example, required that it recover from hitting a May 20 low of -8%. Alas, the month-end was but a temporary respite as the market fall reinvigorated itself with the start of June.

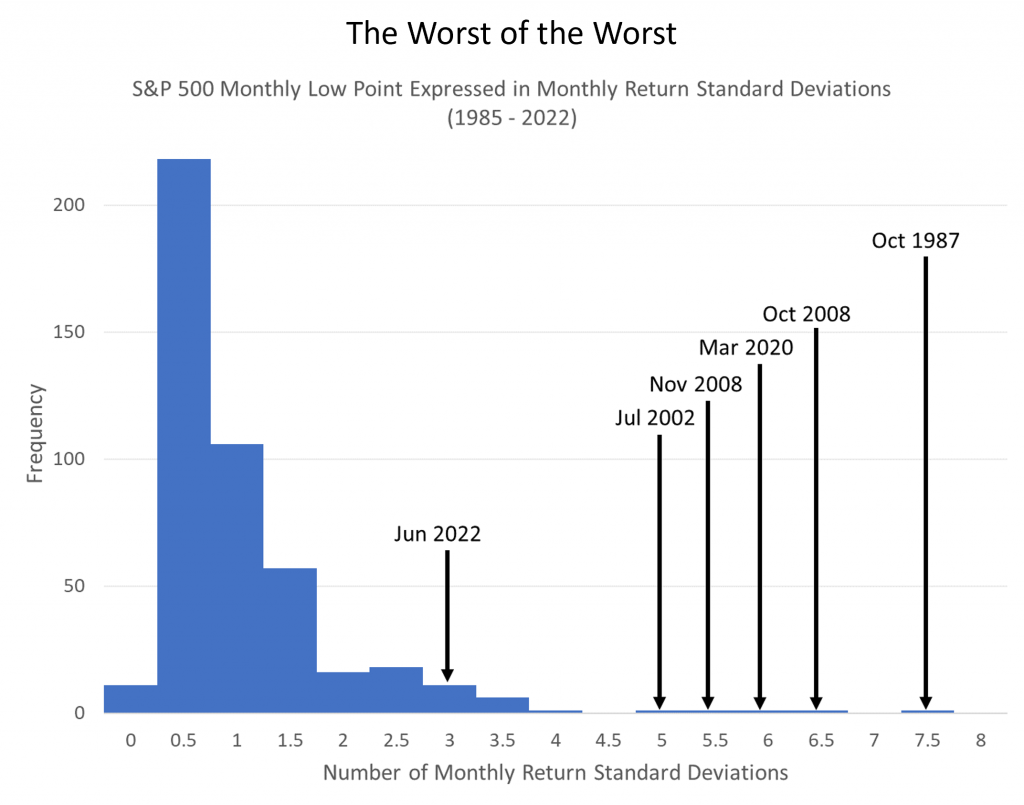

As of June 21, 2022 month-to-date, we have already seen a low point worse than May, with a 12% fall. As the chart below shows, bad though this may seem, it is within the three standard deviations bounds of a normal distribution of the S&P 500’s monthly returns. However, the chart also shows that there is limited value in looking at the behavior of the S&P 500 in the context of a normal distribution, as illustrated by the larger standard deviation events.

It is “easy” (with of course the benefit of hindsight) to pluck from the tail, that all the points occur within bear markets. This is a rather unsettling observation in the current context where the market has slid into a bear market without there being an anomalous negative market event. This is of concern regardless of how one views it. We could, for example, be looking at a long, slow, undramatic, chronic malaise in the market. Or, alternatively, we may only be in the formative stages of a bear market with all of its left tail drama still to unfold.

An AI’s “Understanding”

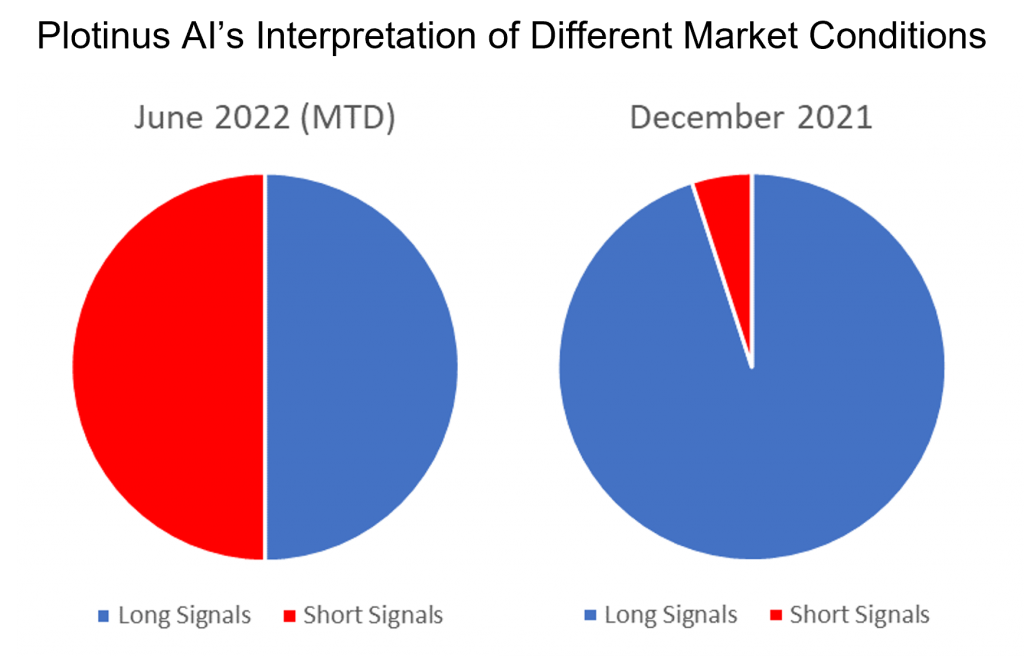

It is interesting from our perspective as proponents of AI trade decision-making as to how these difficult market conditions are “seen,” so to speak, with the eyes of a machine. We have noted how our system has adjusted to the market conditions, which represents for it a new plain of data. The following chart illustrates the generalized change in the breakdown of signal type during the first half of June this year compared to December last year before the market’s troubles began.

This of course is but a brief information snapshot but is still interesting to see the AI’s interpretation of the turbulence we have seen this year compared to the more normal market conditions of last, reflected in its determination of signal type.

A Pessimistic Outlook

What is most disconcerting about the current scenario is the lack of positive indications to balance the negative outlooks. Despite the aggressive Fed action to grapple with inflation it has thus far failed to allay investor fears. The market activity following the latest Fed minutes was testimony to this, swinging wildly down and up, only to end up basically where it had begun.

Furthermore, beyond the US there are no encouraging signs elsewhere. The “cost of living crisis”—aka inflation—is a phrase being bandied around by European politicians and media alike. With a good measure of simplified political expediency, this is being conveniently linked to the war in Ukraine, without much if any addressing of the problem: that the foundations of relative wage stagnation and inflationary pressures that are causing the hardship were laid long before the war began. Additionally, China’s continued upholding of its zero Covid policy, with the lock-down situation in Shanghai only recently being lifted, has injected a deep level of uncertainty into the apparent Chinese economic recovery.

It will have to be seen whether the summer can help brighten the rather bleak pallor of the market. ■

© 2022 Plotinus Asset Management. All rights reserved.

Unauthorized use and/or duplication of any material on this site without written permission is prohibited.

Image Credit: Sekarb at Can Stock Photo.