As US stock market investors watch 2022 draw to a close, the ‘big three’ global macro-economic factors that impacted volatility this year will still be at large in 2023: Inflation, Russia, and Covid. They will continue to drive hard-to-time downward volatility spikes in 2023, impacting, at a minimum, an investor’s short to mid-term risk-adjusted returns.

From a US equity market investor’s perspective, 2022 has been a year defined by the bad news of falling equity markets, inflation, and the fight to control it, and some lessening of Covid’s effect (but it remains neither gone nor forgotten). From a geopolitical perspective there have been two very prominent features: the Russian invasion of Ukraine up-ending norms that have existed in Europe since World War II and the increasingly tense relationship between the US and China.

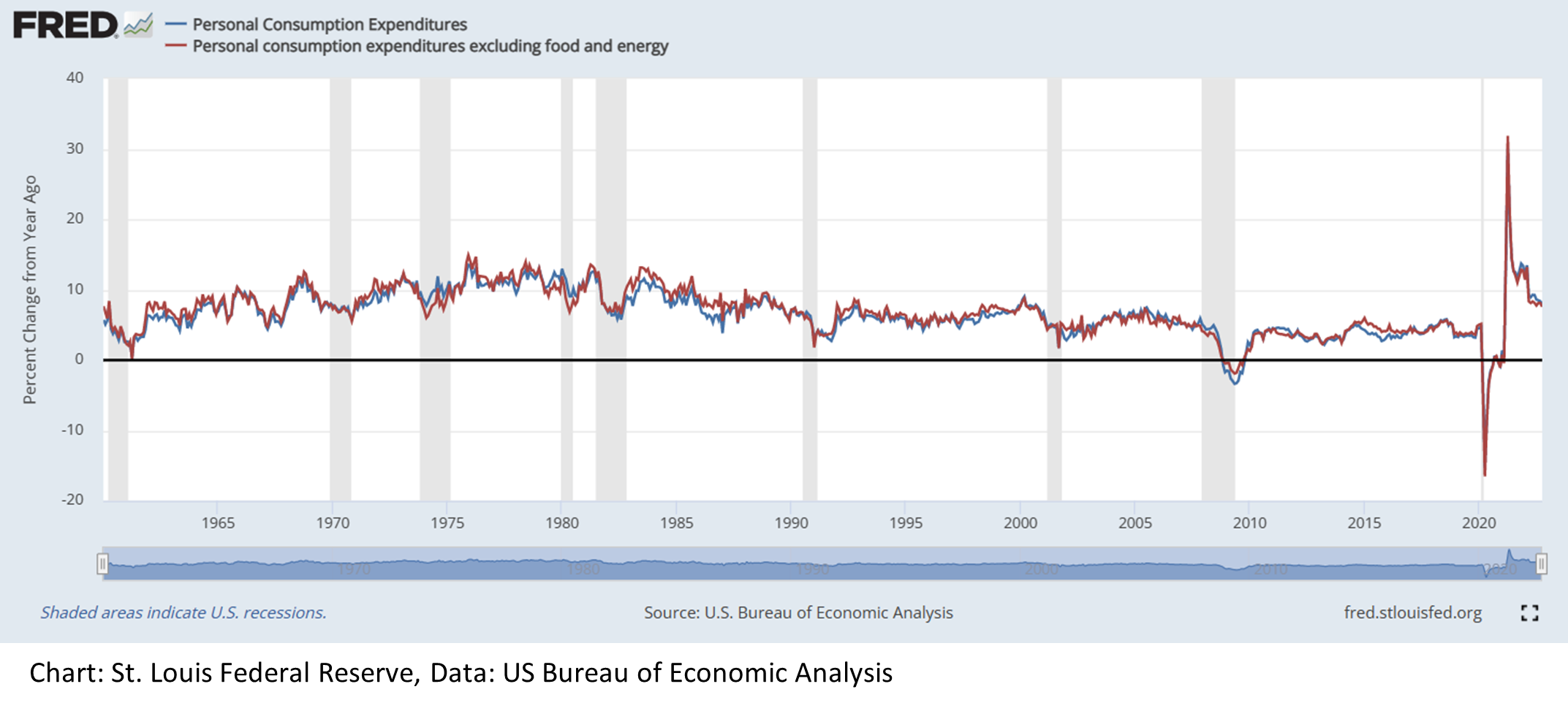

In some interpretations of what has happened this year in the US stock markets investors may have read some assessments that conflated the inflation situation and geopolitical factors. The thoughtful investor, however, will appreciate zooming out to take a broader view of inflation. For this, we share the following chart, which takes us from 1960 to the present, and offers an interesting perspective.

The two key inflation-related disruptions that have been attributed to the war in Ukraine have been the effect on energy and food. When, however, viewed from a US context, the impact of these two factors has been almost negligible in terms of the inflationary situation. The right-hand side of the chart illustrates the minimal differences in 2022 between the Personal Consumption Expenditures and core Personal Consumption Expenditures (which, being of course the Fed’s inflation measure of choice, excludes the two most volatile components—food and energy.

The most striking feature on the chart is not the mild 2022 discrepancy between the PCE and PCE core. What sticks out, literally like a sore thumb, is the aberration of the Covid phase. Whilst an epidemiologist may be able to point out previous pandemics across the 60+ year timeline, given the data in the chart, an economist or market observer could not. It is important to recognize that what is observed on the chart is not a matter concerning medicine, but rather the economic effects of untested government policies, without precedence, both domestically and internationally which applied a handbrake to normal economic activity.

Whilst looking at historical charts can be interesting and sometimes informative, their relevance to different types of readers can vary in their degree of perceived current relevance.

Certain of Uncertainty

The questions on investors’ minds are forward focused: How will 2023 pan out? Market participants are steeped in assessing the impact of inflation (look at the intense market activity surrounding the CPI data report releases in 2022) and the Fed’s every move.

Yet, despite investors’ minds being primarily forward focused, the Fed’s policy making, in contrast, has to be governed by looking at past precedent and past data. Hence the problem: What does one do when there simply isn’t enough data to the right of the aberrative spike to understand the impact (or lack of it) that the spike may or may not have? There is no question that the economy has undergone an aberrative incident, but does it end there? Will things settle back to normal? Or, will the aberrative event’s effects linger in defining a changed normal? The initial Fed interpretation that inflation was transitory was based on the idea that the aberration would quickly rectify itself and inflation would settle back down to the target range.

A year and some 425 basis points of rate increases later, the Fed’s tone has changed to doing whatever is necessary to get inflation under control. This stance is a recognition of the fear of the potential for runaway inflation and the desire to avoid this at all costs. The most likely cost of this policy is recession, but it would be naïve to speak of a Fed induced recession without taking into account what induced the Fed’s current course of action. As thoughts extend toward what lies ahead in 2023 the one thing we can be certain of is uncertainty.

What About One’s Core US Stock Market Allocation?

So, in the context of all this uncertainty, how should investors be viewing their core US stock market allocations?

The potential recession ahead generates uncomfortable decisions about timing the market. If/when to get out, and then if/when to get back in. These dilemmas are occurring against the backdrop of an uncertain range of possibilities: A) No recession, B) Soft landing, and C) Worse-than-expected landing.

So, how one views timing the market is going to be skewed by one’s impression of what 2023 may bring. For sophisticated investors, though, who view their core US equity allocation with a longer time horizon, they may not be interested in trying to time the market. Instead, they may wish to insulate their US stock market exposure from potentially imminent downturns.

Historically, such investors normally had no way to pursue dampening downside volatility beyond taking the step of reallocating some of their core US stock market exposure dollars out of that asset class and into another, with the hope of achieving a comparative see-saw difference in asset class performance to afford them downside protection to their US stock market allocation.

At Plotinus, we discovered that our strategy’s AI trade decision-making investment approach had the potential to provide investors with a different solution to this problem. Our strategy manages to maintain exposure to the US stock market and seek to provide a long-term risk/return profile that both reduces drawdowns and delivers a lower volatility than an equivalent investment in the S&P 500 Index.

There is no question that 2023 ushers in continued times of uncertainty. So, in pursuit of generating greater risk-adjusted returns over the long-term for an investor’s US stock market exposure, it may make sense to evaluate what a different type of new-thinking approach might add as part of that total US equity market allocation. Plotinus is ready to have that conversation. ■

© 2022 Plotinus Asset Management. All rights reserved.

Unauthorized use and/or duplication of any material on this site without written permission is prohibited.

Image Credit: JoPanuwatD at Can Stock Photo.