The Good, the Bad, and the Confusing

March has certainly been a turbulent month for US markets for various reasons, with the most pointed condensing around the fears of a banking crisis following the demise of SVB and Signature Bank. The VIX index crossed 25 for the first time in 2023, indicating how uncertainty has been ramping up. Or was it? The S&P 500 began the month at 3970.15 and it closed at 3971.27 at the time of writing on March 28. A 0.03% change is not particularly noteworthy!

It is best to be careful with phraseology here, not out of a care for linguistics but rather out of semiotics. The stock markets were recently volatile for various reasons, but had those reasons anything really to do with what we thought they had to do with, and how can one assess this?

Let’s take a look at recent investor behavior over the short-term.

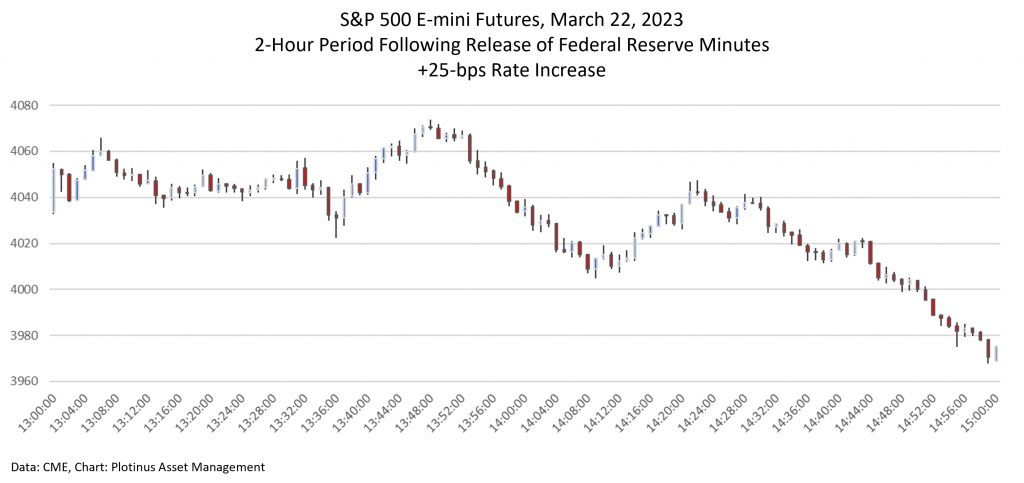

The chart below illustrates the behavior of the S&P 500 Emini Futures contract in the two hours following the release of the Fed Minutes on March 22, 2023.

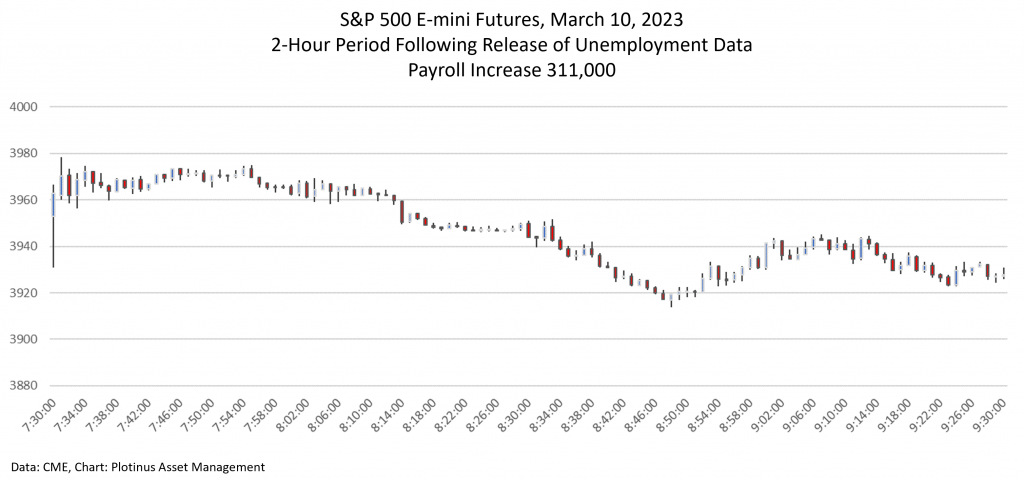

The next is the same, but following the release of the February unemployment figures on March 10, 2023.

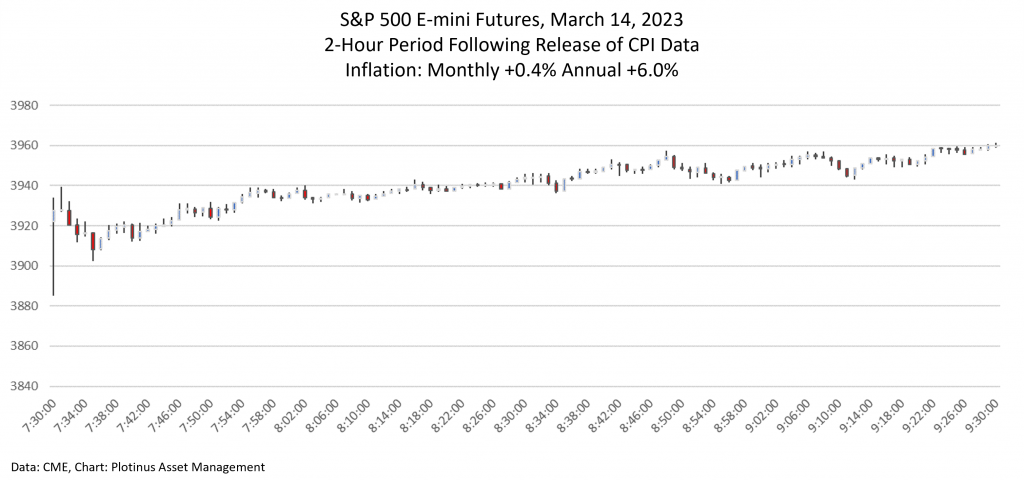

Then finally the same, but following the release of the CPI data on March 14, 2023.

How were investors’ investment processes making trading decisions during these times?

By Way of Illustration

Imagine if one was asked to first assign an objective sentiment (Good, Bad, Neutral) to the information in the data release, and then go on to weight its significance relative to the price movement 30 minutes after the respective announcements.

Then, after performing that task, repeat the designation and weighting decision making, for the hour period, the hour-and-a-half period, and finally the two-hour period after the respective announcements.

There are three reasons why it is extremely difficult to perform this task.

First, is an objective sentiment designation possible? The subjective interpretation will skew this judgement. Was a 25-bps rate hike a good thing, a bad thing or a neutral thing? Answer: It depends on your perspective.

Second, there’s the weighting. It is the subtlety of weighting that will determine the strength of sentiment. How is this achieved without over or under compensating (and therefore mis-weighting)?

Third, how will an investor deal with the relativity of dynamic information and the interpretation of this information? Consider the following progression from Reuters’ reporting at three different time points following the release of the Fed Minutes (our first chart).

15 minutes after the Fed Minutes release:

Fed Delivers small rate hike, says ‘some additional’ tightening possible

The Federal Reserve on Wednesday raised interest rates by a quarter of a percentage point, but indicated it was on the verge of pausing further increases in borrowing costs amid recent turmoil in financial markets spurred by the collapse of two US banks.

Fed policymakers see one more rate hike this year, cuts in 2024

45 minutes after the Fed Minutes release:

Fed delivers small rate increase, says ‘some additional’ tightening possible

The Federal Reserve on Wednesday raised interest rates by a quarter of a percentage point, but indicated it was on the verge of pausing further increases in borrowing costs amid recent turmoil in financial markets spurred by the collapse of two US banks.

Fed policymakers see one more rate hike this year, cuts in 2024

Wall Street see-saws higher as Fed hints at rate hike pause

After the markets had closed (2 hours after the Fed Minutes release):

Fed delivers small rate hike, sees possibility of ‘some additional’ tightening

The Federal Reserve on Wednesday raised interest rates by a quarter of a percentage point, but indicated it was on the verge of pausing further increases in borrowing costs amid recent turmoil in financial markets spurred by the collapse of two US banks.

Fed policymakers see one more rate hike this year, cuts in 2024

Wall Street ends sharply lower after Powell warns inflation fight continues

The information in the marketplace simply repeats and builds. The shared information as the news is updated has been put in bold. What inference is to be drawn from the bolded section? In the first instance there is no reference to market direction, in the second it is see-sawing higher and then finally it ends sharply lower.

This demonstrates the kind of labelling work challenge there is if a portfolio manager is to attempt to use a Chatbot-style or NLP (natural language processing) AI model-based investment process to make active trading decisions.

Manager Due Diligence Considerations

Taking into consideration both the chart-based data and the text-based data of the example above, at the end of all of that, what weighting choices would a Big Data AI-based active trading strategy make, and what impact would this have on its trade decisions?

You have just read two of the kinds of questions that one would expect an educated investor conducting due diligence on portfolio managers running AI-based strategies.

Can AI Help With Investment Irrationality?

Some people have perhaps been over eager in their speculations about the power that fashionable Chatbot-style AI might bring to money management (something which we discussed in our commentary last month). With its great effort to simulate human-like dialogue, is Chatbot-style AI susceptible to the flaws of the confusingly ‘fluid’ human reasoning/irrationality? If so, this would render it an unstable tool for investors seeking to gain advantage by deploying AI strategies based on this.

You have just read two of the kinds of questions that one would expect an educated investor conducting due diligence on portfolio managers running AI-based strategies.

Fortunately, AI’s deployment use in money management has not all taken the same path. There are AI approaches, like the type we use at Plotinus, that are purely mathematical, as in their input data is numerical to begin with. This is in contrast to language-based methods which must transform the language into numeracy in order to be interpreted. By not having this transformational phase, a purely mathematical approach is less prone to the vulnerabilities associated with fluid reasoning.

The goal for those designing better AI trade decision-making technologies is the same as the goal for the educated investor: aim to keep everything robust, while being as simple as possible, and grounded in empirical observation rather than theoretical allure. ■

© 2023 Plotinus Asset Management. All rights reserved.

Unauthorized use and/or duplication of any material on this site without written permission is prohibited.

Image Credit: Robertasch at Can Stock Photo.