Which alternative investments diversify your portfolio?

Investors agree that there are benefits in having diversification within a portfolio. Deciding how diversification should be achieved and to what extent to allow diversification allocations to have a dilutionary effect on a portfolio’s core investment allocation are among the most challenging choices investors have to make.

For US-based investors, as well as many sophisticated investors domiciled elsewhere, the US stock market represents a core portfolio allocation. So, let’s consider what hedge funds might offer, both in terms of alternative returns and diversification, as compared to the S&P 500 Index.

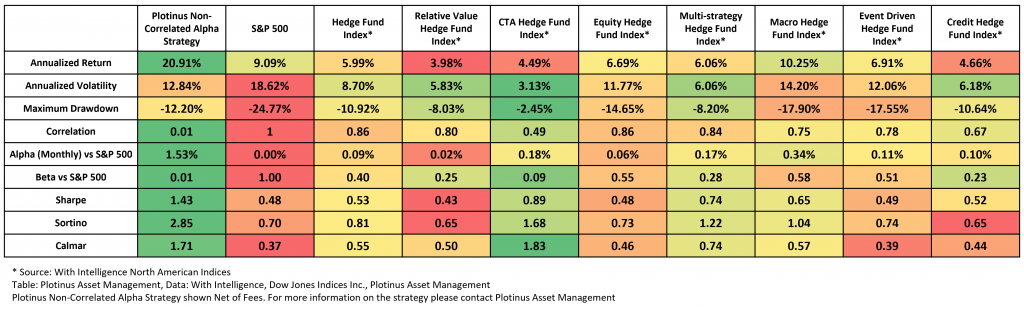

The following table of the five-year period from June 2018 to May 2023 shows various performance metrics for hedge fund indices — provided by With Intelligence, that cover the full spectrum of North American focused Hedge Funds — alongside the S&P 500 Index (representing a core US equity allocation). All of these in this table are in turn compared with the Plotinus Non-Correlated Alpha Strategy, which based on our own research, indicates the advantages of having an AI-driven alternative investment strategy.

At first glance, the CTA Hedge Fund index appears to be an appealing choice among the indices. Although it has the second weakest return, it also exhibits the lowest volatility and lowest drawdown of the group. Further, its low correlation, low beta and well performing ratios all mark it out as the best all round option for those seeking diversification.

However, these strategy advantages pale in comparison to the potential of using an atypical AI-driven non-correlated strategy. This particular AI approach could be faulted on its higher volatility and drawdown, but this is alleviated by it having the highest return.

Differentiated

The most striking thing is how distinctly different this Artificial Intelligence / Alternative Investment strategy delivers versus all the other alternatives, as illustrated by its correlation to and Beta versus the S&P 500 both being 0.01.

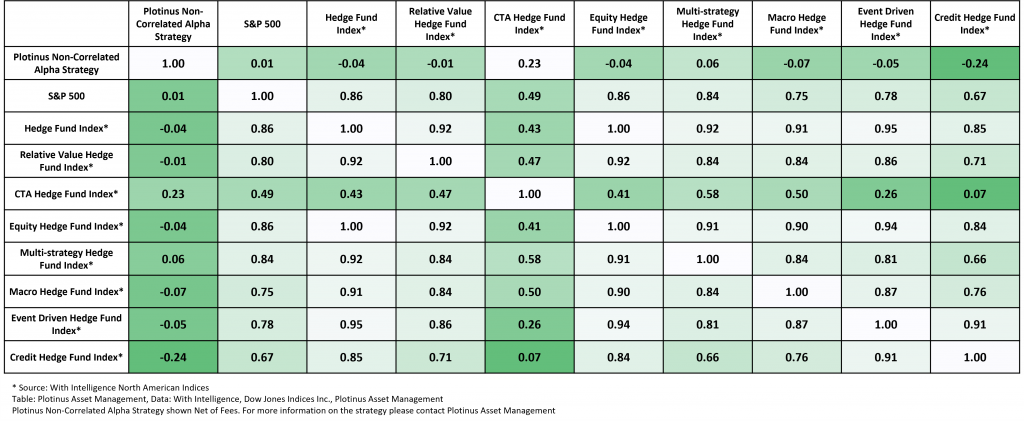

Not only is it non-correlated with the S&P 500 (a typical investor’s Core Allocation) it is also very uncorrelated to each of the hedge fund indices. The following Correlation Matrix makes this even more apparent.

What is all the more remarkable is that the AI-driven strategy used in this case is itself a managed futures strategy whose exposure is to the S&P 500, trading the S&P 500 E-Mini.

The AI trade decision-making in this strategy is clearly generating a very different style of return than would be associated with a CTA – Managed Futures approach. The correlation between this AI-driven strategy and the CTA index is 0.23. This is exactly what one would hope from an AI approach: that it would detect and generate different trading opportunities than conventional methods. This is an example of creating a new approach rather than seeking to build an improved version of a strategy repurposing old ideas.

Here’s the “But”

Artificial Intelligence / Alternative Investment strategies are not all the same. This isn’t just a matter of what asset class a strategy may be investing in. It also, importantly, has to do with exactly how AI is being deployed and what exactly it is tasked with accomplishing.

While the majority of AI/AI strategies in the marketplace are focused on gathering and analyzing big data feeds, the Plotinus Non-correlated Alpha Strategy does not. Big data plays no role in its methodology. Instead, Plotinus generates Derived Data, and makes statistical analytics calculations for portfolio positions and trades off of it.

So, there is a case to be made for AI/AI — selectively run — to deliver, over the long-term, the potential for investors to diversify some of their exposure to a core portfolio allocation (the US stock market) without diluting their exposure to that very asset. ■

© 2023 Plotinus Asset Management. All rights reserved.

Unauthorized use and/or duplication of any material on this site without written permission is prohibited.

Image Credit: Dimaberkut at Can Stock Photo.