What Tourists and European Pensioners Have in Common

It is perhaps only somewhere with the allure of Italy, a bastion of human culture and progress for millennia, that could make an engineering failure a tourist attraction. The Leaning Tower of Pisa has about half a million visitors each year, with millions of euros in investment over the years helping re-engineer a solution to stabilize it and prevent gravity from eventually bringing it crashing to the ground (and Pisa’s tourist revenues along with it). It perhaps could serve as a positive metaphor for the troubling situation for not just Italy’s but Europe’s pension funds and the millions of pensioners they serve.

Foundational Assumptions in Need of Re-Engineering

Pisa’s original engineering failure was the incorrect assumption that the soil on which its foundations were built was strong enough to hold the structure’s weight. The financial engineering error European pension funds made was that they did not properly account for the shifting soil of the population pyramid. This has left pension funds grappling with the prospect of potential future collapse unless some very serious financial re-engineering is engaged in to fix the problem.

Numbers Show the Growing Tilt

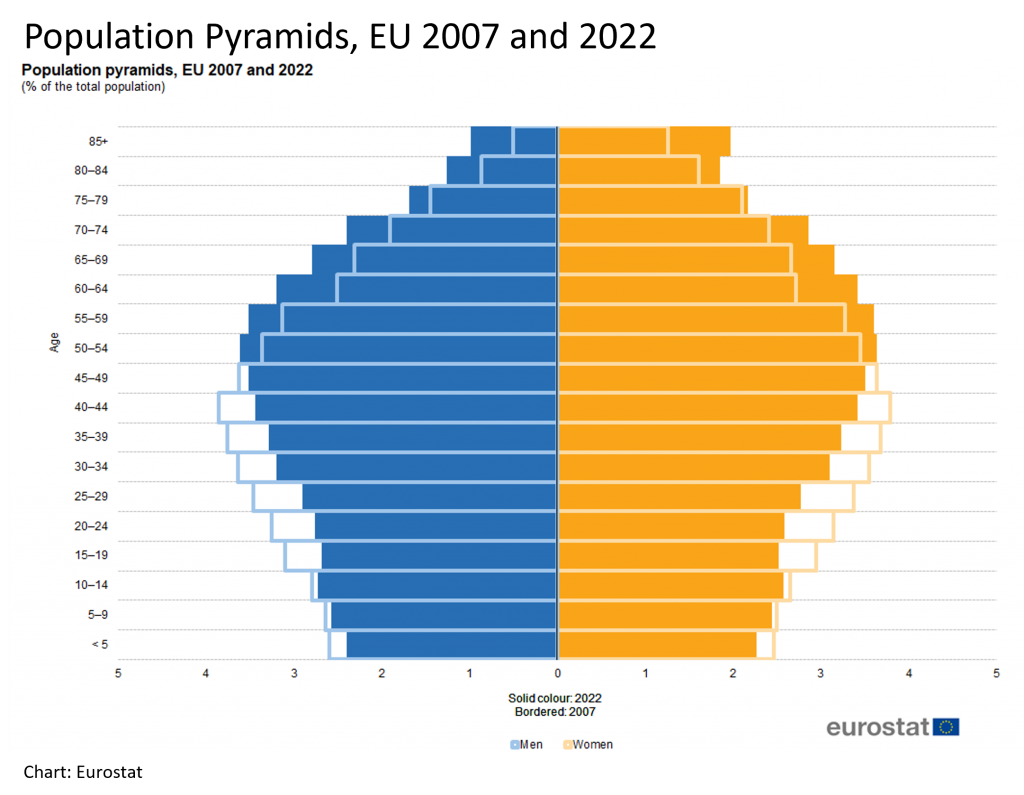

The following chart shows the change in the EU population pyramid in the 15 years from 2007 to 2022. The solid blocks are 2022, the outlined 2007. It starkly illustrates the shift, even since 2007, to an EU with a much larger retirement-age population.

To put what this means in a little more context, it is perhaps more helpful to look at the Age Dependency Ratio. This is the measure of the number of people aged 65 years and over, relative to the number of working-aged people in a population expressed as a percentage of the working-age population. In 2007 it was 26% (approximately 1 person aged 65 and over for every 4 working-age people) by 2022 that figure had increased to 33% (1 person aged 65 and over for every 3 working-age people).

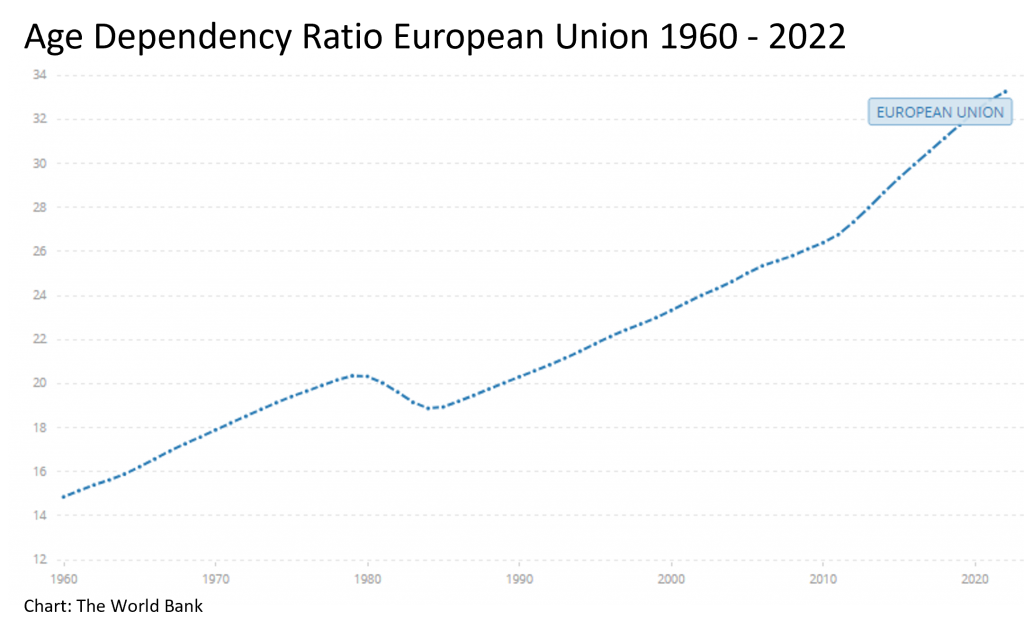

The next chart, from the World Bank shows the Age Dependency Ratio for the EU from 1960-2022. For instance, when the Beatles released “When I’m 64” from their Sgt. Pepper’s Lonely Hearts Club album in 1967 the EU Age Dependency Ratio figure was 17%, in other words there were almost twice as many working-age people to retirees, (six to one) as there were in 2022.

To add further depth to this, the WHO estimates life expectancy at age 65 years old (for current EU member states) to have been 14.8 years in 1969 whereas by 2021 it had reached 19.9 years, an extra 5.1 years. According to the World Bank, that same age group represented 11% of the EU population in 1969, by 2021 that group was 21% of the population. In practice that’s almost twice as many people, all living an average of 5.1 years more. While over the same period the working population of pension contributors has shrunk by half in relative terms.

Governments Can’t Wish This Problem Away

This demographic transition has not suddenly arrived, it has been sitting in front of policy makers for years but given how unpopular an issue pension reform is, it has to a large extent been ignored. A case in point of the degree of unpopularity of the issue, was most recently illustrated by the turmoil caused by France’s 2023 pension reforms demanding an extension of the legal retirement age by two years. This change literally had to be bulldozed through parliament in order for it to become law.

Artificial Intelligence – Will it Exacerbate the Problem or Might it Be Part of the Solution?

As societies become more aware of AI, it is necessary to consider the impact that AI gains in efficiency might have on the broader working-age population. This is very much an open question, with many white-collar jobs potentially meeting the equivalent of a “production-line-moment” akin to what industry experienced with automation, which resulted in increased efficiency followed by lay-offs, followed by longer-term job displacement. From the pensions standpoint the question is, will AI lead to a smaller work force and thus a smaller pool of contributors?

There is however another way in which AI could positively impact the Pensions problem through AI-driven investment strategies.

Rather than risking social unrest of pension reform or even worse—ignoring the problem and hoping it will go away—European pension funds could re-engineer the portfolio risk and allocation constraints of their current investment policy statement guidelines to allow for more a more aggressive returns seeking approach.

“The danger of maintaining an ultra-low risk investment approach assumes that the European pensions system is sustainable into the future.”

There is undoubtedly risk involved in loosing those constraints but the context for doing so must be viewed from the reality: the danger of maintaining an ultra-low risk investment approach assumes that the European pensions system is sustainable into the future. As the change in demographics shows, this is a very shaky assumption.

Some Liquid, Alternative Thinking

Where AI-driven strategies can move in and help become part of the solution is through liquid alternatives investment approaches that creatively diversify and hedge pension plan portfolios’ core equity exposures. This could allow European Pension Funds to increase equity investment and maintain better control on the risk of that exposure. ■

© 2024 Plotinus Asset Management. All rights reserved.

Unauthorized use and/or duplication of any material on this site without written permission is prohibited.

Image Credit: StRa at Shutterstock.