In our previous commentary. we explored the detrimental impact of the profound change in the underlying population demographics on European pensions. As we observed, the financial engineering error European pension funds made was that they did not properly account for the shrinking population of pension contributors and the growing population of longer living pension recipients. This has left pension funds grappling with the prospect of potential future collapse unless some very serious financial re-engineering is engaged in to fix the problem. And we left off with a suggestion that a solution could come through the addition of AI-driven strategies within the asset allocation mix.

From the plan management perspective, the two biggest mid- to long-term threats to European pensions are underfunding and lackluster performance. Putting the politics of underfunding aside, let’s consider how performance might be re-engineered.

First Part of a Solution: Bigger Market / Bigger Return

The US stock market is the biggest and most liquid in the world, and over the long-term its returns continue to surpass returns from European markets. Yet, historically, many European pensions have had little to no exposure to the US stock market. Maybe now is the time for that to change.

A conservative approach to adding such an allocation for European pensions would be to add a passive exposure to the S&P 500 by buying the index.

That decision is relatively easy and straightforward. More thought, however, is needed for deciding how to hedge the US stock market volatility risk to the portfolio.

Second Part of a Solution: Choosing Your Hedge

So, how to best hedge the volatility from US stock market exposure?

It would be reasonable to evaluate what North American-focused alternative investment strategies might offer for offsetting some of the associated volatility of S&P 500 returns. Many asset allocation strategy types can be benchmarked, but not all. AI-based investment strategies are so relatively new and so tremendously diverse, from analytics modeling to inputs used, we believe institutional investors would be best served putting in the due diligence time to see and consider the implications of one methodology’s strategy implementation details from another.

That said, let’s examine some comparative risk/return data to see what hedging an S&P 500 allocation in different ways might look like.

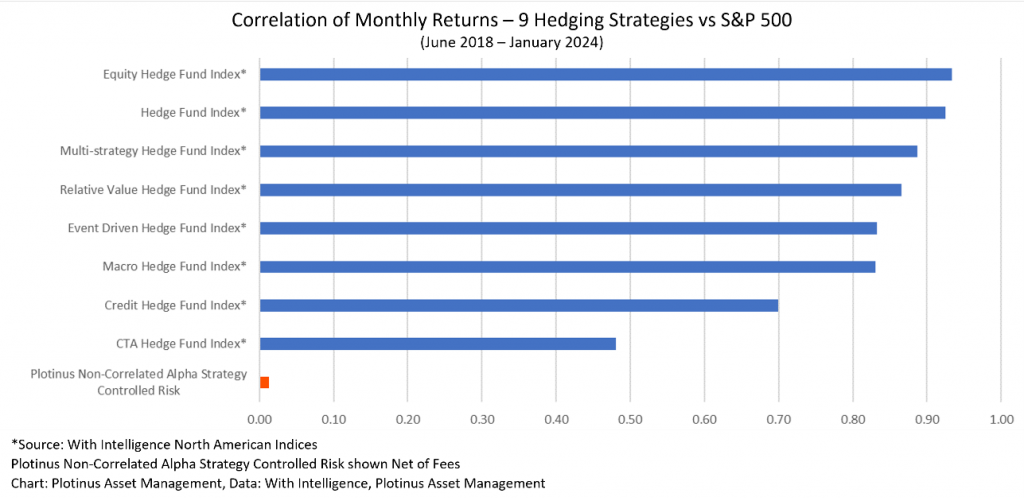

What the institutional investor wants to look for is difference; or, more precisely, could an AI-driven hedging strategy exhibit difference? The standard mathematical method of observing similarity (and by extension difference) is correlation. The following chart shows the correlation vs the S&P 500 of a selection of eight North American focused hedge fund indices compiled by With Intelligence, and one of Plotinus’ own AI-based US stock market focused strategies.

The lack of correlation displayed above by the AI-driven strategy is immediately apparent: 0.01 compared with 0.93 for the North American Equity Hedge Fund Index. Given that the function of a US focused hedge fund is to “hedge” equity exposure it is notable that six of the eight indices show a correlation vs the S&P 500 greater than 0.8. The effect of this similarity to the equity exposure—or the lack of meaningful hedging—can be seen if the index is combined with the S&P 500 in a ratio of 1 to 1.

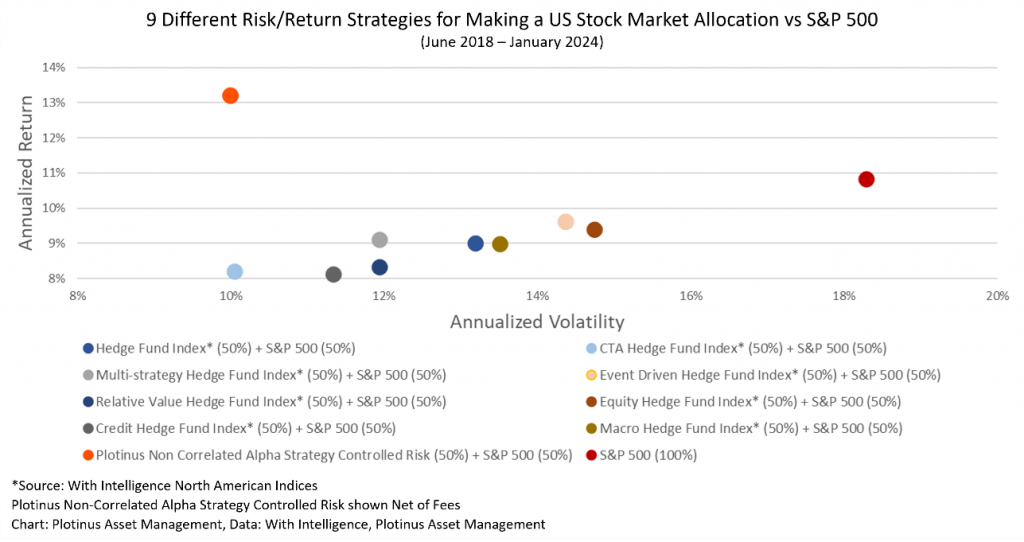

The next chart shows the impact on the risk/return profile of this combination, with the 50% S&P 500 exposure plus a 50% hedging strategy exposure (rebalanced on a monthly basis), compared with an unhedged, straight exposure to the S&P 500.

In the chart above, you will find the unhedged S&P 500 exposure as the red dot appearing on the far right. Moving from right to left, one sees that all the traditional hedging strategies share two traits: reducing the volatility (which is good) and reducing the return (which is bad, but is considered to be the cost for hedging). In fact, the compromise is almost linear. The lower you want your volatility, the more returns you must be prepared to sacrifice. Looking, however, at the far left, one notices that the performance of the AI-based hedging strategy is distinctly different (the orange dot). Unlike all the other strategies it actually improves returns while also reducing the volatility. It has both the lowest volatility of the group and the highest return. Compare this with what the CTA Hedge Fund Index delivered. While that has the second lowest volatility, it also has the second lowest return of the group; so, the reduction in volatility with that strategy comes at a high cost.

The unusual behavior of hedging with the AI-driven strategy here responds directly to the conundrum European pensions face in deciding how to pursue higher returns, taking on a new asset class portfolio exposure, and managing the added risk inherent in that.

US Equities Market + a Low Vol Hedge, With Some AI Help

What some AI-based investment strategies may offer is the ability for European pension fund managers to accommodate more risk within their portfolios, while being able to reduce the volatility of a US equities market exposure without compromising potential hedged returns. Such a combination solution may help add to the total return of pension portfolios and promote the long-term growth that pension funds need, while tempering that added risk that comes with pursuing added return. This could prove to be a conservatism in investment decision making that would be good for the long-term investment goals of European pension funds. ■

© 2024 Plotinus Asset Management. All rights reserved.

Unauthorized use and/or duplication of any material on this site without written permission is prohibited.

Image Credit: Robert_Hoetnik at Shutterstock.