As the S&P 500 finishes its best first quarter performance since 2019, the concentration of the performance of the whole index in just a few stocks has been much noted. In particular its top performing stock, NVDIA with its +82% YTD, has contributed in excess of 5% to the index YTD.

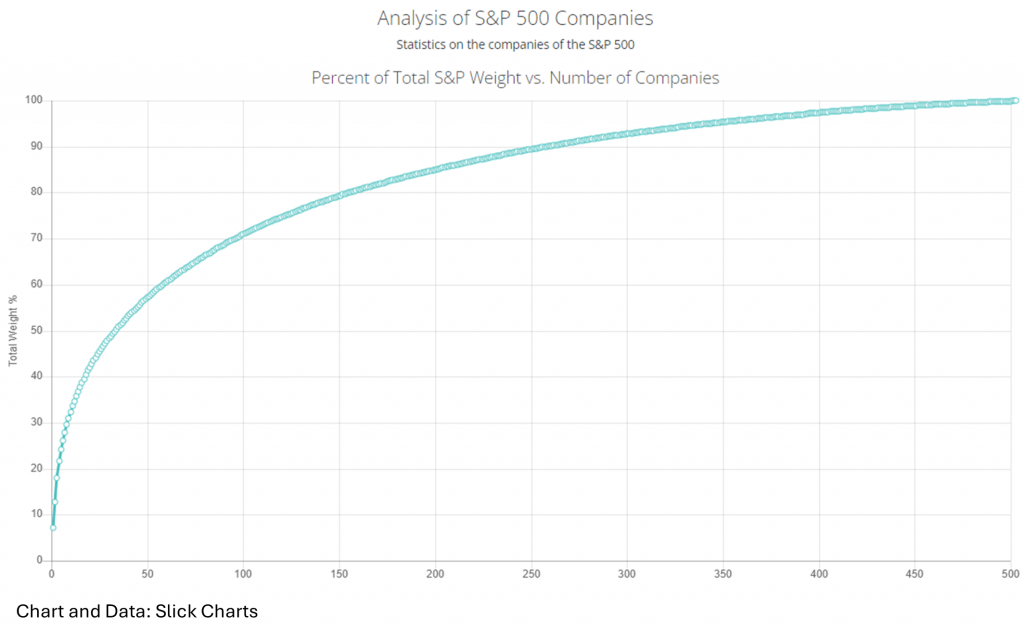

This highlights a broader reality, that the market cap weighted index increasingly resembles a pareto cumulative distribution-like character, as shown by the chart below.

One can see that the market capitalization of the top 50 companies in the index account for 58% of the entire market capitalization of the index. This, like many other winner-takes-all phenomena, exhibits growing concentration. As recently as 2021 for example, the top 50 made up 54%. So, what is the effect of this growing concentration? Is it a potential risk or an opportunity?

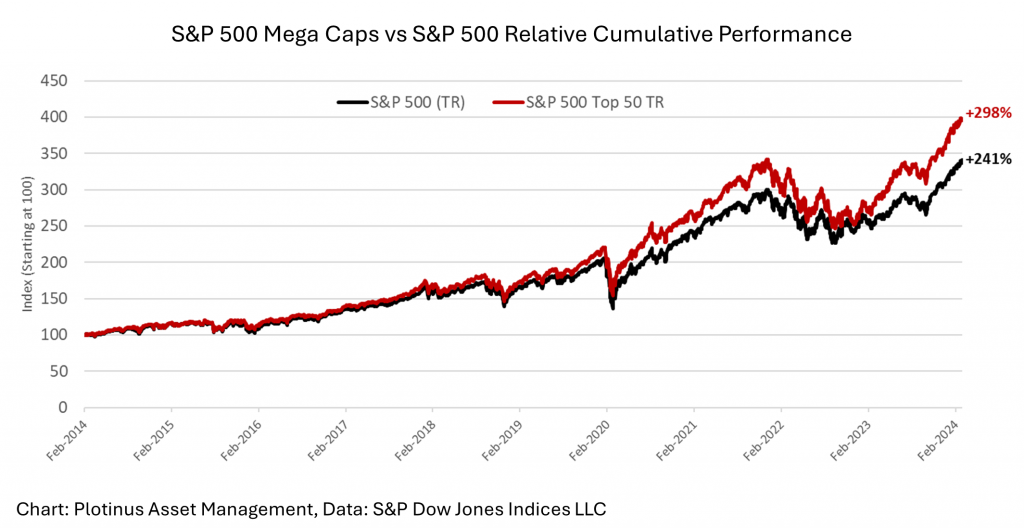

To explore this let us look at the total return versions of the S&P 500 Top 50 index vs the S&P 500. Over a 10-year period, the Top 50 bettered its broader counterpart by 23% making a cumulative return of 298% vs 241% (see chart).

Interestingly from a risk/return perspective the Top 50 index is only mildly more volatile and clearly presents a better risk/return profile. In these ten years, it has an annualized return of 14.60% with a volatility of 15.59% compared with the S&P 500 TR 12.96% return with a volatility of 15.16%.

The Weakness of Sameness

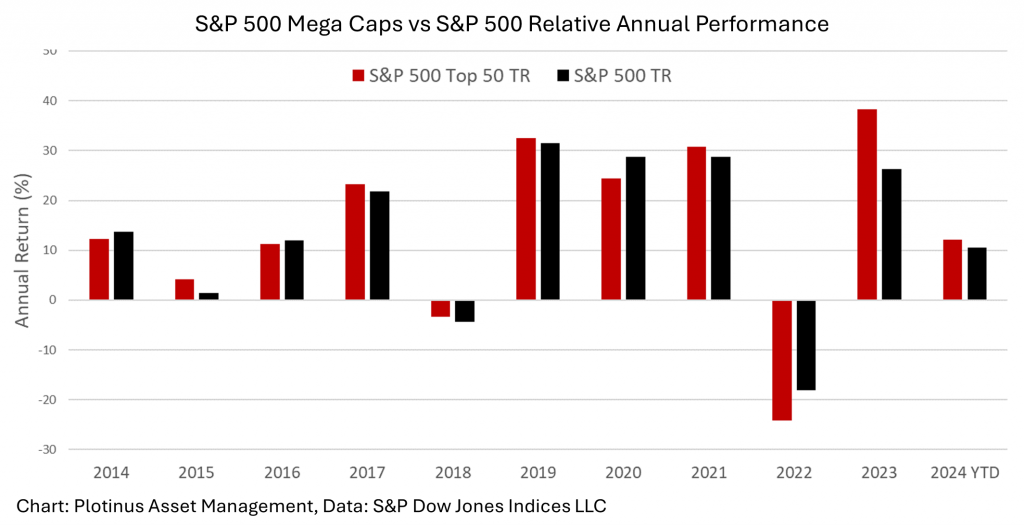

This rosy picture of outperformance is what we see if we look at annual performance over the same period. The mega-cap selection does better in 7 out of 10 and it is also outperforming so far in 2024.

What these charts do not illustrate, however, is that there is further concentration in the concentration. Were we to zoom in further on the top 20 and then the top 10, one would observe a similar pattern. The drivers of the whole index remain the whales of the index. Hence focusing on them to the exclusion of the other constituents, simply dilutes the diversification that the broader index gives. This in turn leads to the conventional observation that diversification reduces volatility but at the expense of returns.

It is noteworthy that 2022 resulted in a significantly better (though negative) relative performance by the S&P 500. This indicates the weakness of over concentration. The increasing sameness of the upper end of the mega-cap companies necessarily means that they are exposed to similar dangers. In the event that conditions are against them, like the impact of inflation/interest rates, for example, the exhibit the same vulnerabilities.

Breaking Beyond the Conventional

Plotinus’ thinking on deploying AI to enhance investment decisions is that an AI approach must be able to offer insights that we do not observe from conventional approaches. Thus, an AI approach that is designed to view investment decisions differently should therefore be able to deliver solutions beyond what is available through standard methods.

This has led us to develop AI Trade Decision-Making that can actively manage a US equity index investment so that it can act as a hedge to a core US equity portfolio exposure. Hedging but without departing from the asset class. What this means in practice is that we have developed an approach that manages to defy the conventional risk/return compromise. Diversification is not just confined to trading different instruments. It is also possible to generate diverse returns by trading the same instruments, but in different ways. This is where AI, if used correctly, can offer alternative solutions that can help de-risk the increasing concentration present in mega-cap US equities. ■

© 2024 Plotinus Asset Management. All rights reserved.

Unauthorized use and/or duplication of any material on this site without written permission is prohibited.

Image Credit: Robert_Kneschke at Shutterstock.