With less than a week to go to the US Presidential elections the race remains a dead heat. The broader US stock markets do not appear, at least on a surface level, too perturbed by the high degree of uncertainty in the electoral outcome. At time of writing, October 29, 2024, the NASDAQ is up +2.88%, the S&P 500 up +1.22% and the DJI trailing at -0.23% month to date.

Regardless of whether the US stock markets seem unphased about the outcome, the result is being watched intently globally, in a way that perhaps reflects more about broader world-wide uncertainty than the US election itself. This global focus and anxiety appears to be mostly expressed in discussion around the differing geostrategic viewpoints of the two presidential candidates and the potential consequences for areas of regional tensions with deeper international implications, from Ukraine to the Middle East to the South China Sea. We have on occasion discussed in previous AI-Insights, that while it is important for investors to be aware of geopolitics, it is also easy to over emphasize politics’ impact on investing.

In the Money

Looking at this from a slightly different perspective, that of world capital, it is understandable that there is such intense global interest in US domestic politics. Sixty-one percent of the world’s stock market investment is in the US. This represents a very high degree of concentration of capital in one country’s stock markets. The level of relevance to the rest of the world is reflected in the fact that this share of global capital is more than twice the level of the US’ dominance in terms of world GDP, which stands at twenty-five percent. Thus, what happens to the US stock markets is highly relevant to practically every nation on earth.

It is interesting in this context that David Kostin and his team at Goldman Sachs released their decade’s outlook on the S&P 500. A glum prognosis suggesting that the ‘Old Faithful’ of equity returns could be running dry, giving an annualized total return of only 3%. Dull though this may seem, were this assessment to be accurate, it is much more likely that this will have a greater long-term impact on the globe than the result of November’s election. The reasoning behind the analysis of a much weaker S&P 500 in the years to come is based on the issue of over concentration of the larger companies within the index itself. This leads one to ponder what the geopolitical effects would be, in the event that US stock markets disappoint in this manner and there is a bleeding of international capital from the US to elsewhere?

Passing on the $35 Trillion Dollar Question

To add to the troubling forecast for the S&P 500, there is growing concern for the ongoing sustainability of the level of US debt. Opinions on this range from those who think it is the bubble of all bubbles to others who consider that it can continue to be managed responsibly. Rather than drawing an either/or conclusion it is enough to register that the speculation is real, the worry is real and portfolio positioning is taking place now. Be that from abandoning or even shorting long-dated treasuries to insulating against extreme tail risk. On the other hand, there are investors who, considering the weak outlook for US equities, would for instance prefer a 4% return from bonds. Then of course there are those who will simply stick with a classic 60/40 Equity/Bonds portfolio in the expectation that it will protect their investment over the long term.

Can an AI Strategy Act as an Offset for Bleak Future Equity/Bond Returns?

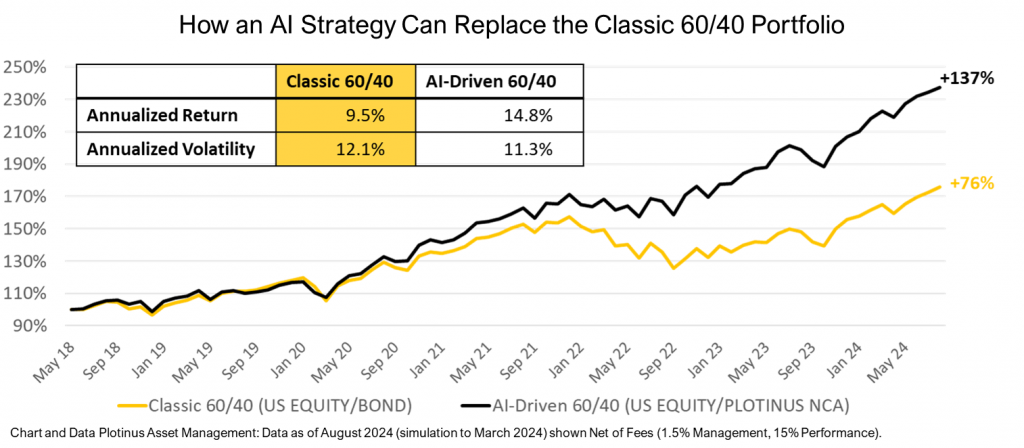

Unsurprisingly, we at Plotinus are of the opinion that an artificial intelligence investment approach offers a way for investors to navigate through a more uncertain decade. Our own analysis indicates that using a US equity futures strategy with negligible correlation to US equity as a replacement for the bond component in a classic 60/40 Equity/Bonds portfolio, is more effective at suppressing volatility and protecting long-term returns than this traditional approach.

One of the lessons of the past few years has been the unexpected correlation between bonds and equity in a falling equity market. Given the suggested low returns for the S&P 500 over the next ten years, and the erratic nature of its volatility, the prospect of a reoccurrence of an equity/bond correlation in a falling equity market is rather unpalatable. As the chart illustrates, taking a different approach using AI trade decision-making offers the sophisticated investor alternatives to plan for and weather a decade of uncertainty. ■

© 2024 Plotinus Asset Management. All rights reserved.

Unauthorized use and/or duplication of any material on this site without written permission is prohibited.

Image Credit: Bodhichita at Shutterstock.