In the world of US stocks, the past two years have been quite focused on AI. The excitement around this has been epitomized by the outsized success of NVDIA, which has seen its share price increase eight-fold over this period. During that time, we have seen NVDIA’s market capitalization increase to over $3.3 trillion as it jostles with Apple for the title of largest company in the US by market capitalization. November saw its inclusion in the Dow Jones Industrial Average. Somewhat ironically, it replaced rival chip maker Intel in the index, surely something that should foretell a tale of caution!

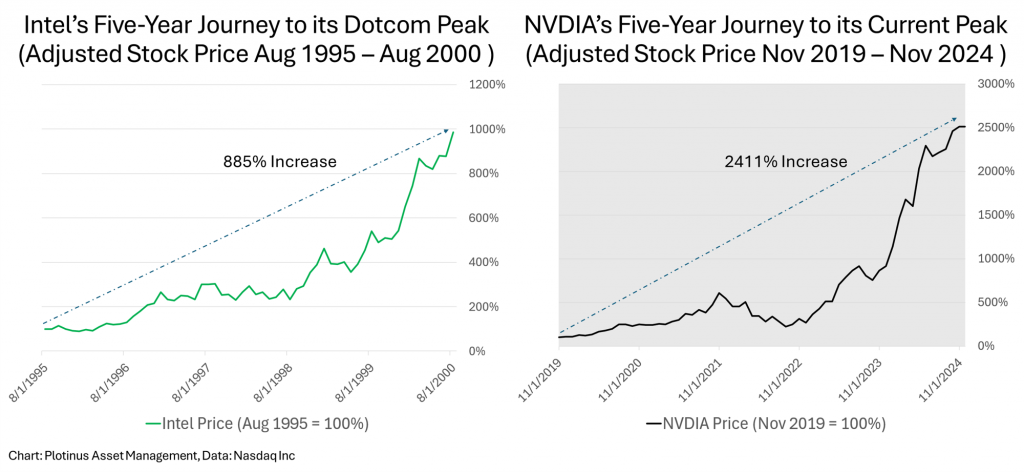

NVDIA’s success has been framed in the context that they are the shovel makers of the new AI goldrush. The company makes the hardware that those digging for value to be found by using AI need to have to successfully do so. The parallels with Intel from the earlier internet era are clear. The sudden enthusiasm for Open AI, Anthropic AI, and the like has echoes of the Dotcom boom. For the purpose of illustrating these potential similarities, let us compare Intel’s stock price rise pre-Dotcom bust and NVDIA’s current ascent.

As can be seen from the charts, Intel’s adjusted stock price increased an enormous 885% in the five years prior to its Dotcom peak in August 2000. NVDIA’s rise in the past five years, however, blows this result away. Its adjusted share price has increased an astronomical 2411%, more than 2.7 times that of Intel. If there is any lesson from history—a point very much open to debate—it surely is to be gleaned from what happened to Intel’s share price post that Dotcom peak. That fact is what should be troubling current NVDIA investors.

To put this in context, Intel was making the best chips on the market in 2000, and it kept on doing so for many years until its competitors (including NVDIA) caught up and surpassed it. We can recognize with hindsight how economically valuable the internet has gone on to be long after the Dotcom bubble has become a distant memory, but in knowing this success, it is easy to forget the frenzied over-hype that created the bubble and its subsequent bursting.

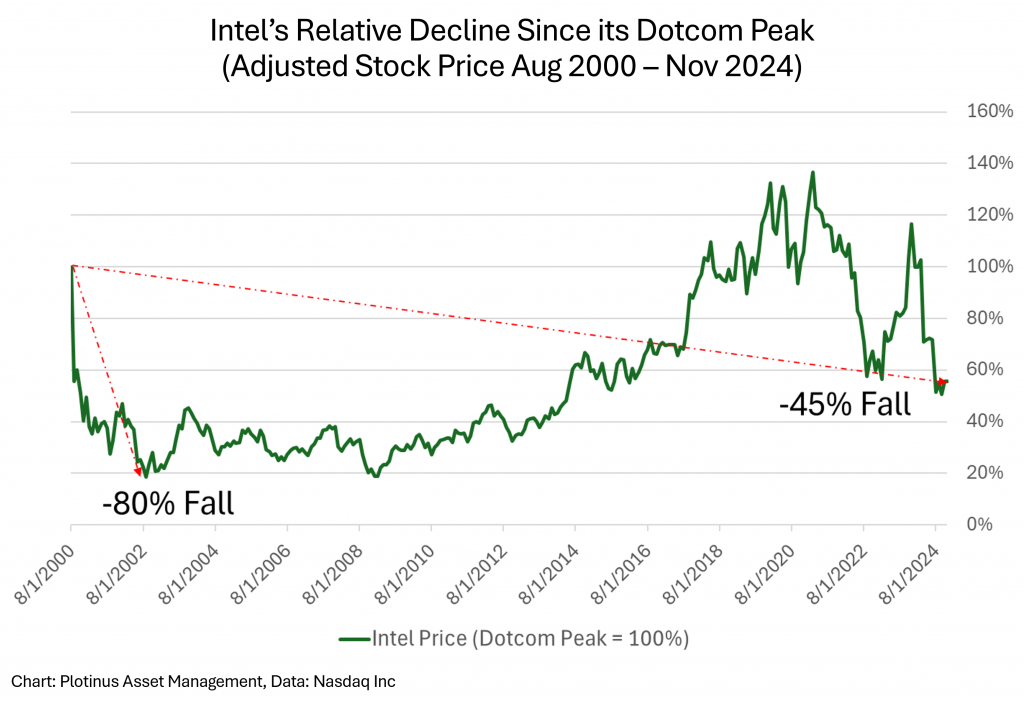

Bearing this in mind, let us now look at how Intel fared post its Dotcom peak. The next chart illustrates how it has performed in the almost quarter century since. In the precipitous fall during the bust phase, it lost 80% of its value. It then took 18 years to reach the peak again, only to fall to 55% of the original peak value from 2000 in the last six years.

A Quality/Value Paradox

If Intel is viewed across the 25 years it spent in the DJIA, it gained only 9% compared to 317% for the index as a whole. Compare this to Microsoft, which was included as a tech company in the index at the same time in 1999: it has increased 1410%. A sobering comparison. Of course, we should consider that for every tech survivor from the Dotcom bust there are legions in the grave, but that is the very argument that at the time made Intel look like the obvious good bet—back the shovel maker, the hardware that everyone needed. The problem with that bet was that its premise, manufacturing quality chips, remained true throughout the last quarter century. Yet, that viewpoint did not translate into a quality long-term investment.

For those investors looking to capture the smart AI investment move, perhaps it is time to hedge the obviousness of a NVDIA investment and consider that AI development at the implementation level is most likely heading in the direction of more efficient data usage/less processing. Hence the relative advantage bestowed by NVDIA’s Blackwell AI chips will almost inevitably decrease over time. There once was a wow factor with Intel’s Pentium III processors from 1999 and those processors were superseded time and time again by Intel as it made better and better chips, irrelevant in the context of Intel being a good stock pick. What investors need to do now is to identify the AI implementation companies, that stand to become the Microsofts of tomorrow. ■

© 2024 Plotinus Asset Management. All rights reserved.

Unauthorized use and/or duplication of any material on this site without written permission is prohibited.

Image Credit: Anggalih Prasetya at Shutterstock.