The US stock markets seem to be encountering a form of identity crisis, the last couple weeks, bull to bear to bull again. They could be forgiven were they afraid to look in the mirror to see which animal was peering back at them. When on a whim, utterances such as “Our discussions with them (the EU) are going nowhere!” can knock off a percent and a half and “I had a very nice call with her (Ursula Vonder Leyen)” can add two percent to the major indices, perhaps the markets have become some half bull, half bear minotaur creature of Greek mythology.

So how should a portfolio be managed in markets that have the capacity to swing so significantly in either direction? A simple question with many answers depended on the viewpoint and desired outcome of the portfolio manager.

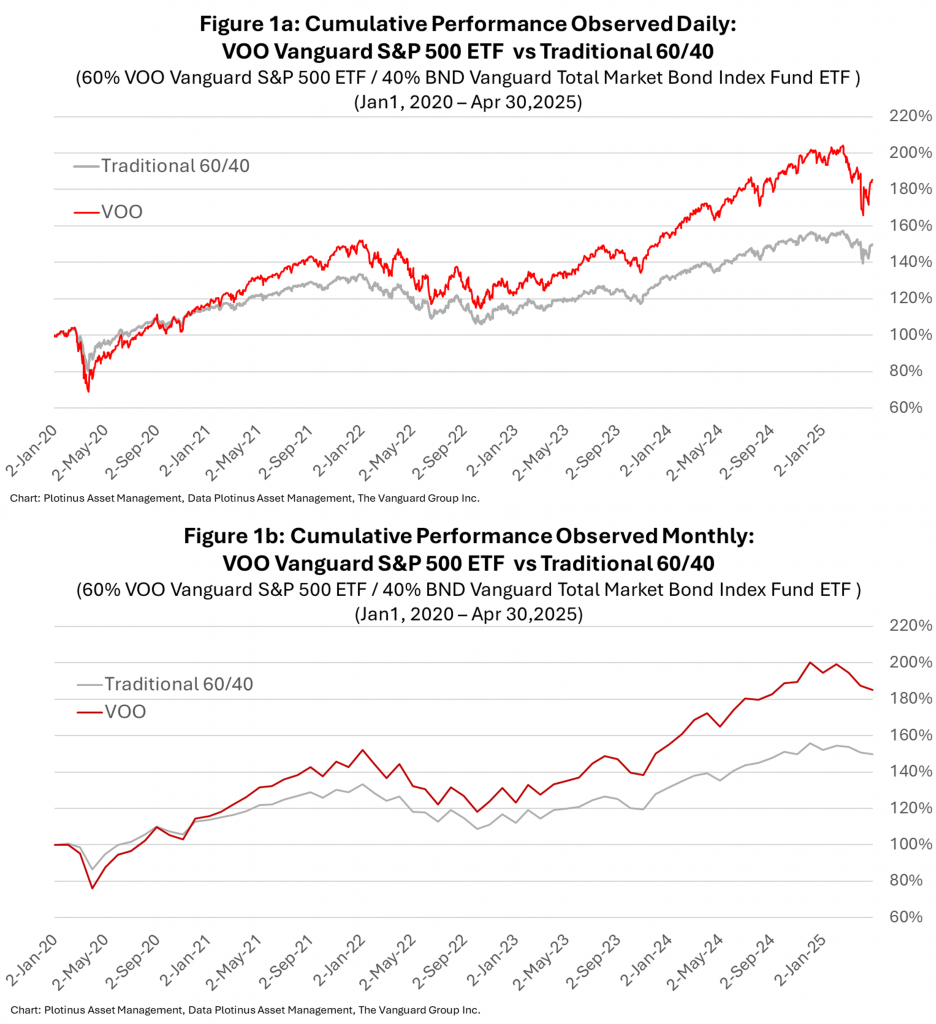

There continues to be much debate on the validity of the traditional 60/40 Equity/Bonds portfolio. Let us for a moment enter into that debate and a deceptively simple look at a sample 60/40 illustration over a period from January 2020, from two different perspectives of time, daily and monthly.

The smoothing effect of the longer observation granularity is patently obvious, but we are looking at this in order to illustrate the difference between theory and practice.

Surges in market volatility are not some weather-like phenomena that sweep over the market, disturbing it. They are the reflection of an intensification of the dispute of opinion that the market is, usually intensified by uncertainty and rapid shifts toward herd-like behavior. Panic represents one of these shifts. Suddenly if everyone is selling, this leaves the individual with the question have they got it wrong and should they sell too? This is when all the rationales on holding a long position go out the window, overwhelmed by a new rationale that in their wisdom, the crowd, knows better than the individual. Maybe yes, maybe no. It is at points like this, where damaging portfolio decisions are made. When in the granularity of trading by tweet, the deceptive calm of monthly returns can often be forgotten.

During “Liberation Week” between the close of April 2 to the close of April 9 the S&P 500 had a range of 21.6% from a low of -12.1% hit on April 8 followed by a upward burst of +9.5% on April 9. It is in situations like this that investors can make costly mistakes. These rapidly changing circumstances can have profoundly different effects on investment outcomes, An apparently sensible decision to bail out of the falling market, would be the difference between April’s monthly return for their S&P investment being -12.1% had they exited the market on April 8, or -10.3% if they left the market on April 8 and re-entered on April 10, cursing the mistake of misreading the President’s “Good time to buy” April 9 social media post compared to -0.76% if they stayed in.

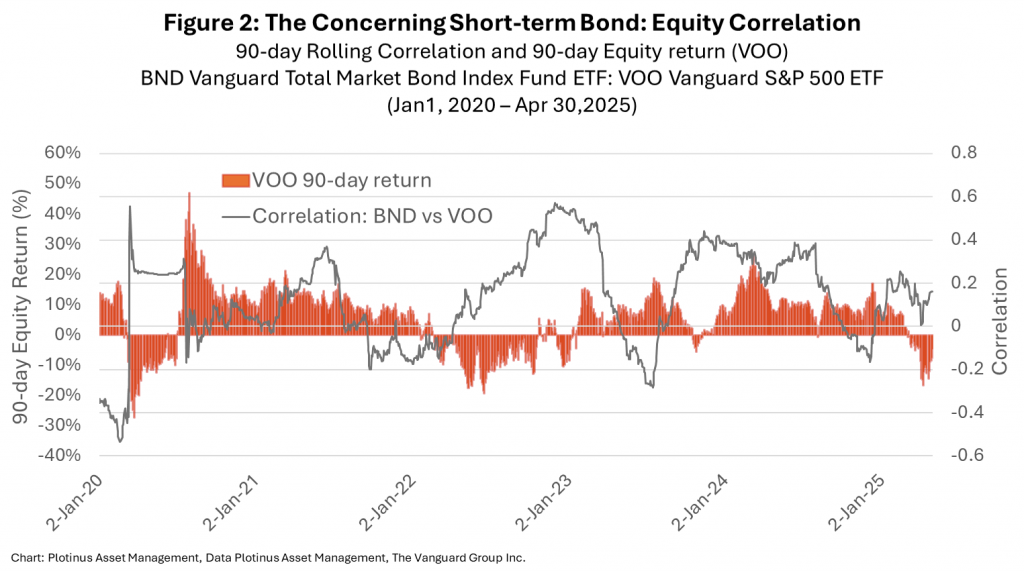

There is a disturbing observation in a supposedly safer 60/40 portfolio which has a compounding effect on the tendency to panic in market falls. The correlation that the bond component has to the equity component in a 60/40 appears to increase during times of stress. This runs at variance with the long-term logic which assumes anti-correlation to equity in a falling market, therefore insulating the portfolio from large drawdowns and reducing its overall volatility. While there is plenty of evidence to support this concept, when viewed over the long term. This fails to assist many investors who are tempted to abandon the calm logical and opt for what seems to be a very sensible yet completely contradictory urge to seek immediate safety in moments of trouble. Something which as we have already discussed that would have been severely damaging in April, from a long-term investment perspective.

The 90-day correlation between the bond and equity components viewed in relation to the 90-day return of the equity component since January 2020 is shown in Figure 2. One can observe how increasingly a positive correlation occurs as the equity allocation is performing badly. Not the kind of information needed to help an investor stay calm.

Some Ancient Greek Wisdom

To return to our ancient Greek theme from earlier, maybe some philosophy can assist a perturbed investor, Plato to be precise. In the Phaedra Plato explores the balance of the soul using an allegoric tale depicting the soul as a horse drawn chariot made up of three components, two horses and a charioteer. The Charioteer represents reason, the two steads seemingly opposing impulses, one, courageous, obedient to the instruction of reason, the other wild, passionate, disobedient and potentially reckless.

For our purposes, we shall (please forgive the crassness) degrade Plato’s aspirations to understand the essence of the human soul, commandeer his symbolism and apply it to portfolio management. The Charioteer will represent the portfolio manager and each steed two different time perspectives. The first is the slow, logical, calm, long-term view with its multiple monthly returns where the tumult of the moment can be ignored in the bigger slower picture of investment. The second by contrast is the wild irascible imminent view of now, troubled, nervous and tempted to act with impulsive, deep conviction, regardless of logic. Thus, we have the (presumably) rational portfolio manager dealing with the patient rational, and impatient irrational outlooks.

The imposition of the rational on the irrational may seem at first as an obvious and simple solution in both the philosophical and investment context. However, this is a short-sighted appreciation of the problem.

If all rational focus is applied on the problem horse, the energy applied to do so, risks becoming over concentrated, which ultimately acts as a drag on the forward motion of the chariot. If the Charioteer’s only occupation is one of restraint, while this may tame the wild horse, it similarly restrains the obedient horse too, resulting in slowing the progress forward. In recognizing the futility of bending the will of the irrational, Plato suggests that the governance of the soul is an active management issue, reining and loosening the competing elements. It is critical to remember that there are two elements present at all times. The ultimate objective being that on the whole, a rational outcome will be achieved through balance.

Guidance Tools to Help Investors With Balance

From the portfolio management standpoint there is a parallel. In moments of crisis, it can be very difficult to take the focus off the fast-paced crisis itself and instead remain calm enough to let it run its course. This first bout of tariff induced chaos has done just that, run its course. After a few wild weeks the S&P 500 for example is more or less flat year-to-date, having been down almost 20% at a point. All very simple it would seem, but the reality is rather different than a post event analysis with the benefit of hindsight.

The main problem is that the investor’s competing time perspectives are both real and often contradictory. It is very easy, after the event, to say that it was the right move to stay in the market and capture the April 9 jump, but it is similarly easy to say that had an investor exited the market on April 2 and rejoined on April 10 they would have missed both the fall and one of the largest single day gains ever and still have been better off than the purely passive investor who had experienced both.

In our estimation, the investor actually requires additional tools beyond the conventional, to help them balance these two, time-oriented realities. The traditional 60/40 was meant to do this, but considering the emerging flaws in the model due to crisis correlation incidents it requires improvement. To its credit the model has one major advantage—simplicity. This is something that is frequently undervalued. Simplicity allows for problems to be seen relatively quickly, and it makes addressing those problems easier. That said, though, the 60/40 model does not suffice as enough of a protective mechanism to weather the risk of short-term, fear induced interference, disrupting the objective of achieving more consistent long-term gains.

So How Can This Be Improved?

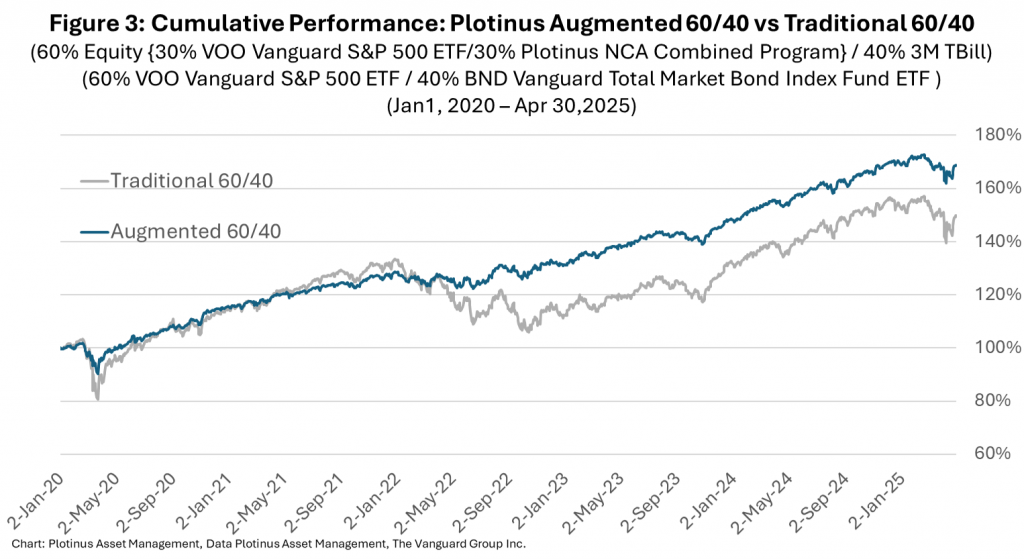

Our suggestion for improvement is to redefine what both the equity and the bond component of the portfolio looks like. We would opt for the addition of a liquid non-correlated alternative investment. Our preference would be to augment the equity exposure by using the alternative investment to create a diversified return within the equities spectrum and to move away from the traditional bond aggregate and more towards the short end of the bond spectrum.

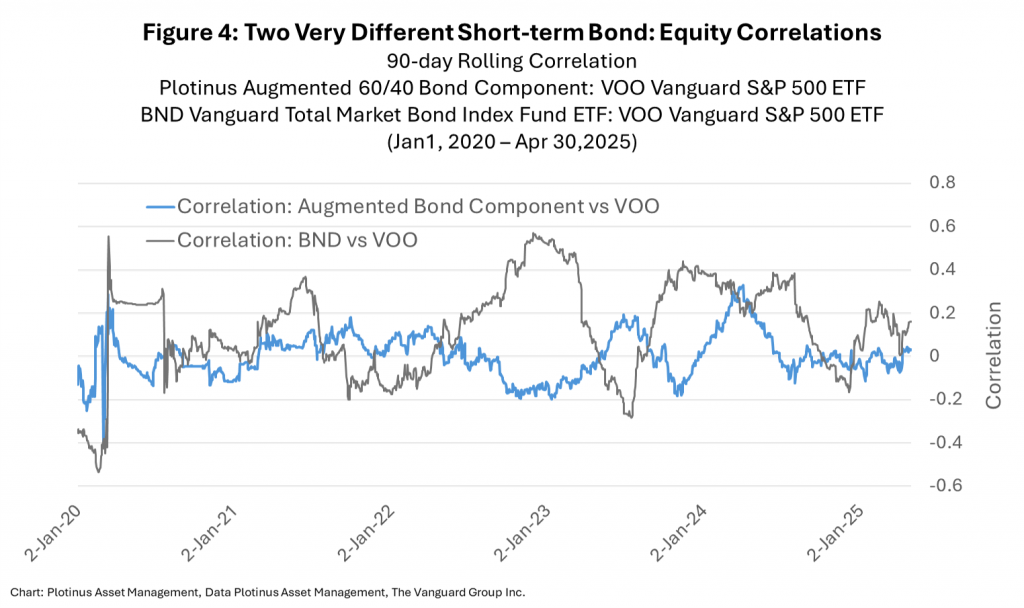

The use of a futures strategy (like the Plotinus Non-Correlated Alpha program shown in Figure 3) with efficient margin usage, for example, enables a substantive portion of the bond allocation to remain in risk-free equivalents helping reduce the short-term correlation of returns in a market crisis event. Compare for instance the contrasting correlation profiles of the bond components in Figure 4.

The purpose of this approach is to help stabilize the returns from a long-term investment perspective and also see this same stability reflected in the daily returns perspective to help protect against the errors that can be created in response to sudden market falls. To return to our Platonic analogy, by taking this approach we make the Charioteer’s job easier to maintain a balance, helping preserve the investor’s long-term investment goals as they pass through times of deep market strife. ■

© 2025 Plotinus Asset Management. All rights reserved.

Unauthorized use and/or duplication of any material on this site without written permission is prohibited.

Image Credit: Paula_cobleigh at Shutterstock.