A cocktail of growing concern around over inflated AI valuations, deteriorating consumer sentiment, uncertainty around the broader US economy mixed with a lingering sense that the party may not yet be over, has seen US stock markets experience a nervy November.

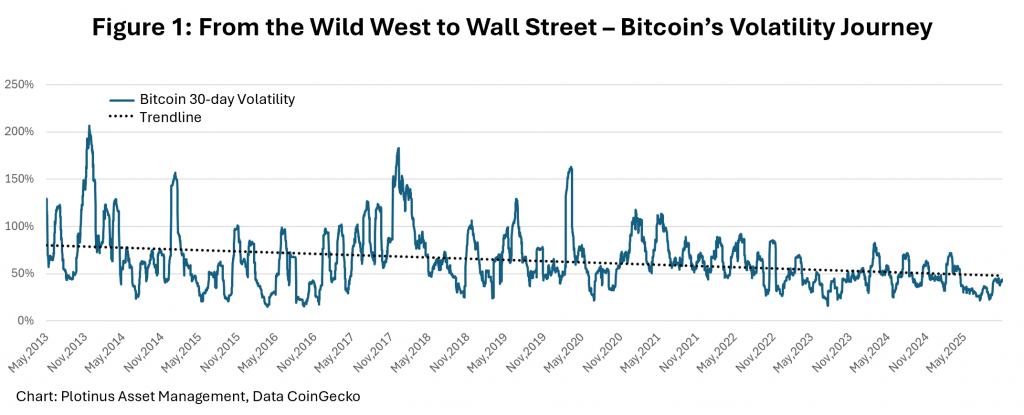

Into this turbulence we would like to look at a very recent, but interesting phenomenon – bitcoin as a potential risk indicator. Bitcoin’s trajectory from deregulatory idealism into the Wall Street establishment’s heart, beyond having the storyline of a Greek tragedy, illustrates the transitioning from wild speculation to institutional speculation. This is shown for example by the decline in its volatility over the last 12 years (see Figure 1).

This transition to institutional speculation means that bitcoin has gradually over time become more representative of risk appetite in the broader market.

To be clear, this exploration can only go so far. It is severely limited by the short time period during which this change has taken place. Though it is still worth looking at, for investors who are trying to assess whether they should be repositioning their portfolios defensively to a more risk-off stance.

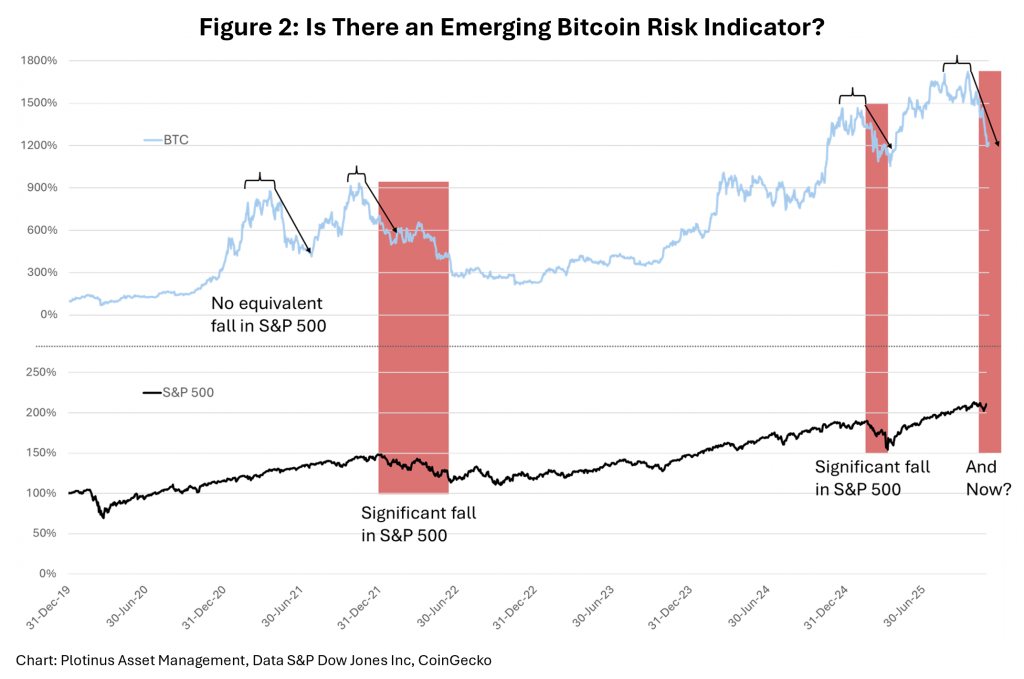

As Figure 2 illustrates, there appears to be an emerging relationship between sharp declines in the price of bitcoin and subsequent declines in the S&P 500 (as a representative US index). One can see looking at the chart that there is something of a pattern between bitcoin forming a wobbly double peak followed by a distinct fall (more than 20%) which is then followed by a significant decline in the S&P 500 (more than 15%). Though there is not a direct conclusion to be drawn (we have shown a clear example in 2021 where this observation in bitcoin is not the precursor to a fall in the S&P 500) it is worth considering how the changing nature of bitcoin as it becomes increasingly institutionalized might affect the connectedness between both instruments.

An interpretation of this relationship could be that as bitcoin has become more mainstream, it represents the more aggressive risk appetite of mainstream investment. Hence the logic that, when there is a selloff in bitcoin, this might be indicating that mainstream risk aversion is kicking in. Thus, by reducing riskier bets first, this will latterly translate into a risk off approach to US equities, as investors’ appetite for risk wanes.

If this is valid, then what is observed in this relationship in the past few weeks suggests that the brakes have been applied to aggressive risk taking. This indicates that as we wind up the year, setting up portfolios more defensively for 2026 seems to be a sensible course of action.

As we are often prone to point out, however, conclusions drawn from seeming patterns on charts should be treated with great caution. Humans have the ability to perceive patterns in randomness, which have no more meaning than that these patterns themselves, are nothing more than the product of randomness. That said, however, if there is a core logic behind some observed interrelationship in data, it can be useful to add to the risk assessment process.

There remain very strong opinions about the inherent worth/worthlessness of bitcoin and Wall Street’s adoption does not necessarily answer that question. But whether or not one is invested in it as a store of wealth or not invested in it as a store of dreams, at the end of the day perhaps observing bitcoin as an indicator, can, like tulips, be something nice to look at. ■

© 2025 Plotinus Asset Management. All rights reserved.

Unauthorized use and/or duplication of any material on this site without written permission is prohibited.

Image Credit: Nieriss at Shutterstock.