The S&P 500 spent the first half of the month in negative territory, followed by a second half rally, which saw it breach the symbolic 3000 mark and eventually leave it behind. The S&P 500 ended the month -10% down from its all-time, pre-coronavirus high on February 19th and +36% up from its March 23rd low.

This upward motion in the markets could not be more starkly in contrast with the social upheaval that has swept the country in the past week in response to the death of George Floyd.

Meanwhile US unemployment as of April stood at a staggering 14.7% with estimates suggesting that May’s figure could reach 19.8%. The real economic pain behind these numbers is still to be experienced and nothing as yet suggests any semblance of a ‘V shaped’ recovery in this field.

This has left many investors scratching their heads, trying to figure out what is going on. Which is reflecting reality? Main Street, Wall Street, both, neither or the anger on the Streets?

Alright With Me in America

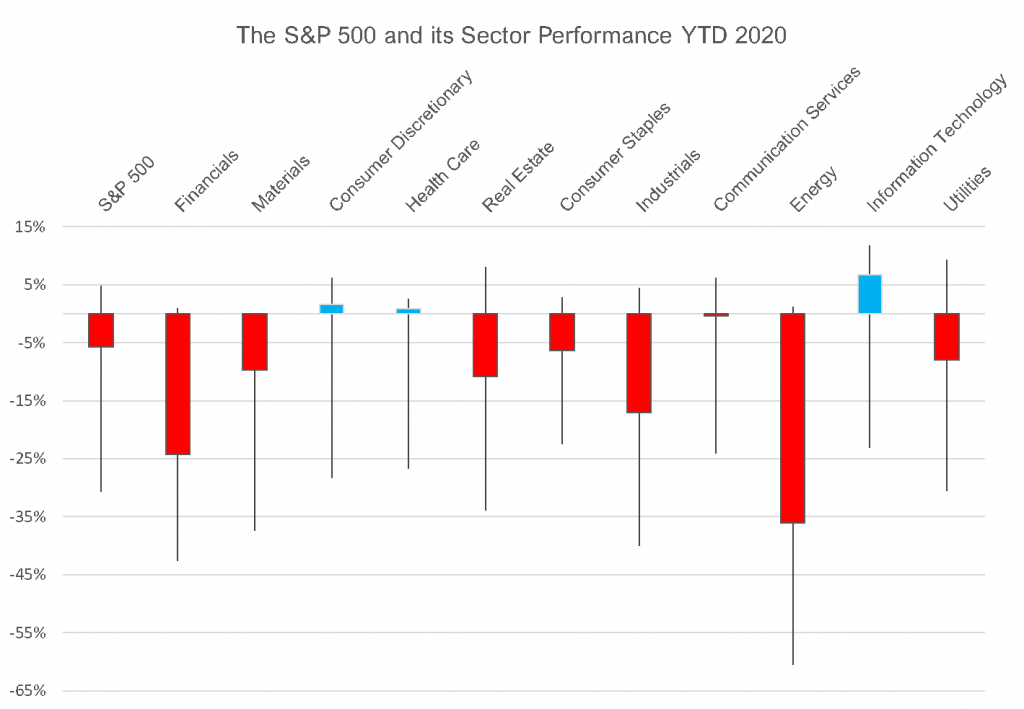

A quick sector breakdown of the S&P 500 shows the three positive performers year-to-date: health care and information technology perhaps not surprisingly, consumer discretionary a little less so. To be clear nothing escaped the terror of the March plunge, but these three sectors have all helped in the rollback from the abyss. The other sector, communication services, which although still just in negative territory for the year is far outperforming the S&P 500 overall. This is to be expected given that it contains Facebook, Netflix and much of the soma-generating entertainment factories that nurtured the world through a happy, brave new lockdown.

Chart: Plotinus Asset Management

Everything’s Free in America

Well not quite free, more like well-priced. Considering that the index is still off by 10% from its February high, there is ample room for growth with many sectors looking like they are excessively low: energy which has been its own crisis within a crisis and financials which is understandably reflecting overall economic concerns.

I Want to Be in America

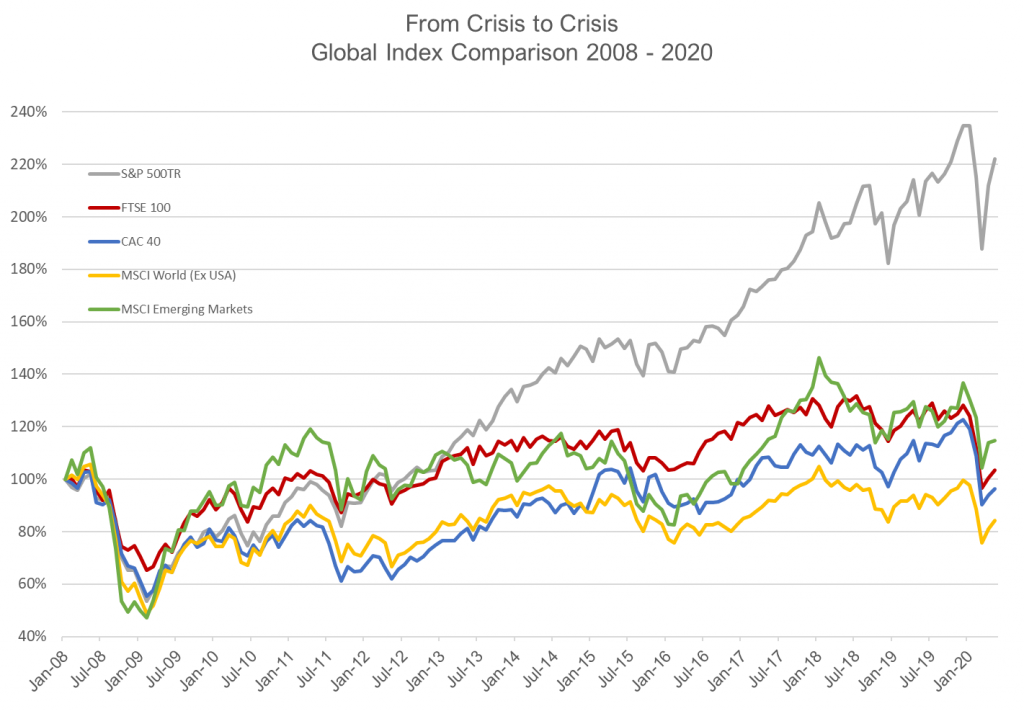

Clearly US equities are not immune from dramatic falls in value, as most recently seen in the Covid-19 crisis, but their long-term relative outperformance has historically offset those destabilizing disadvantages. This is highlighted particularly when one views the similar and additional traumatic loss of value experienced by its counterparts across the globe.

Chart: Plotinus Asset Management

Looking from a global perspective, US equities have understandable allure. Furthermore, taking into account that cash, now carries with it increasing cost, there is growing pressure to emerge from this current crisis rapidly, by getting money back to work. In this context US equities have the potential to become a proxy for some of what would otherwise have previously remained in cash.

In our opinion there is a building opportunity for investment managers with innovative US equities strategies that address and mitigate the inherent disadvantages like the recently seen 20% drawdown through March of this year. Those like ourselves – who are exploiting leading-edge technology such as Artificial Intelligence to generate these types of strategies – are well positioned to be the real beneficiaries of new, post-crisis asset inflows. ■

© 2020 Plotinus Asset Management LLC. All rights reserved.

Unauthorized use and/or duplication of any material on this site without written permission is prohibited.

Image Credit: Sergey Kamshylin at Adobe Stock.