The New Year gives us a moment to reflect on the impact of 2020. What was a grim year economically, proved to be a stellar year for some financially. Meanwhile, the uncertainty of the lockdown further validated our AI-based approach to stock-market investing.

The Pandemic

This is obviously the issue that probably defines 2020 for most people. Looking at it from the isolated perspective of its impact on US equities, when viewed from the year end, to quote Mr. Sinatra, “It was a very good year.” The NASDAQ had a stellar 43.6%, the S&P 500 a significantly above-average 16.3%, and even the Dow with its traditional tilt toward the very hard-hit industrials sector managed to clock in a 7.2% gain. All of this despite the markets responding with a violent panic at the end of February into early March, as Europe began its lockdowns and the old familiar norm disintegrated. Compare that for example to the UK’s FTSE 100 which rounded the year with -15.2% (this loss was substantially mitigated by a post-vaccine-announcement recovery). As we noted in our August white paper Artificial Intelligence: The Post-Pandemic US Equity Strategic Allocation, the US equity markets had absorbed the pandemic, and contrary to the prevailing atmosphere of pandemic gloom, there was plenty of room for growth ahead.

Artificial Intelligence Strategies

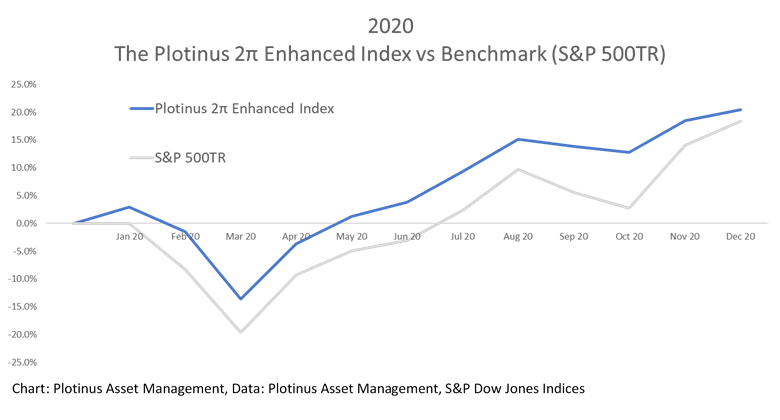

The lack of any meaningful precedence for the kind of upheaval witnessed in 2020 was a tremendous acid test for Artificial Intelligence trade-decision-making as a technological approach to asset management. How, for example, did Plotinus’ AI systems hold up? We were very pleased. As one highlight of our efforts, the Enhanced Index outperformed its benchmark.

The Plotinus 2π Enhanced index returned a very solid 20.5%.

Lessons Learned?

The experience with US equities in the last twelve months, in spite of its uniqueness, can be understood in a broader macro environment that has been developing over a number of years. The low interest rate conditions seem likely to remain for the foreseeable future, having the effect of further tilting the balance of attractiveness toward equities. Combine this with the hypothesis that due in part to the growth of passive index investing, the US market indices are no longer just a reflection of general economic health, but that they are increasingly an actual measure of the current and future wealth of the nation. This means that maintaining and protecting US indices by default becomes an indirect part of national monetary policy in which the indices in effect are “too big to fail.”

This dynamic can be seen in the aforementioned disparity in performance between the US and UK mainstay indices. It is also particularly interesting that this need to protect the indices is apolitical. Two recent incidents provide illustration of this. When one considers the stark political divisions, the flipping of the senate following the Georgia run-off elections, was received positively by the markets. Furthermore, in light of the extraordinary scenes from Capitol Hill, the markets’ response was only a brief jitter. None of this of course makes the US equity market immune from turmoil, but one must always consider that when it hits hard times, repercussions are likely to be felt globally (as we saw in early March). The key difference between the US market and the rest of the world is that the US market is propelled by the scale and strength of the US economy, enabling conditions for a more rapid rebound even in extremely difficult circumstances. ■

© 2021 Plotinus Asset Management. All rights reserved.

Unauthorized use and/or duplication of any material on this site without written permission is prohibited.

Image Credit: Surasit Bunnet at 123RF.