Who would have predicted a year ago, from the trough of the pandemic crash, that the S&P 500 would cross the milestone of 4000 on April 1, 2021? Its symbolic importance increases considerably when it is considered in the context of what a highly unusual 12 months it has been.

The broader question of course, pertains to the future not to the past. It is one of sustainability, how long can this growth continue?

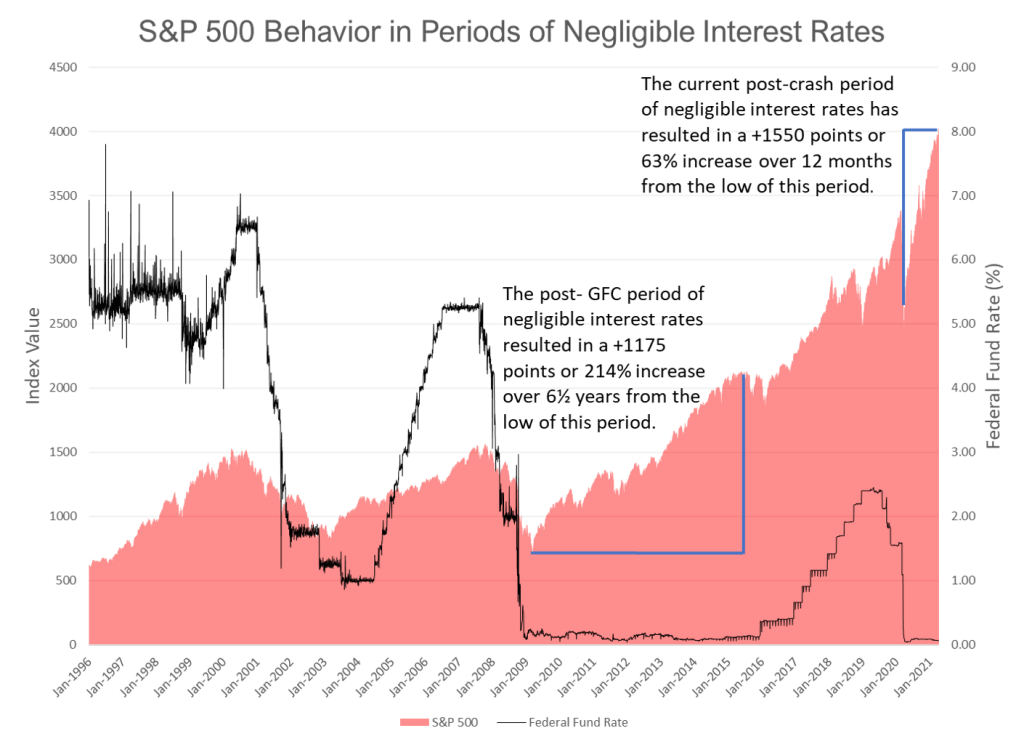

The chart illustrates how the conditions of negligible interest rates, as a response to the market trauma in 2008 and last year, are intrinsically related to the stock market recovery in both cases. Their characteristics though are somewhat different.

Taking negligible rates conditions to be from when the Federal Fund rate first dropped below 0.10% at the end of December 2008, interest rates averaged 0.13% for the next six and a half years, ranging from 0.04% to 0.25%. The S&P 500 rose to a peak of 214% from its low during this period. The rate of the recovery was most rapid in the first year, it rose 68%.

In the past year, the Federal Fund rate first dropped below 0.10% at the end of March 2020. It has averaged 0.08% since, ranging from 0.04% to 0.10%. From the low during this period of negligible interest rates (this occurred on April 1, as distinct from the absolute low of March 23, which occurred before the negligible interest rate period had begun), the S&P 500 has grown 63% in 12 months, less rapidly than the first 12 months post the low of 2009.

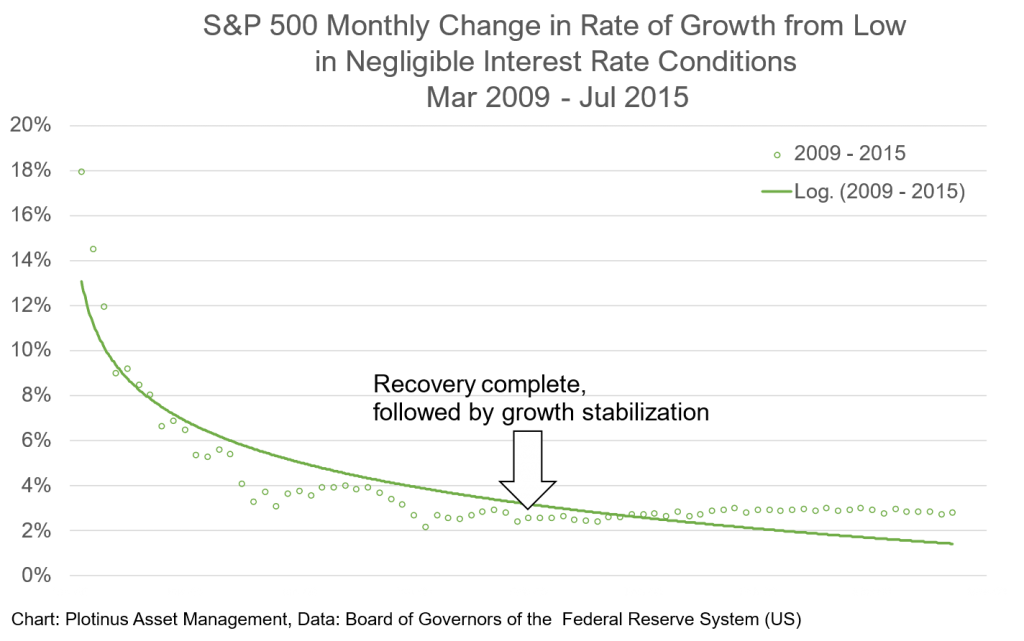

A feature of the post 2009 period is the stabilization in the change in the rate of growth once the market had fully recovered and was adding new growth. Ultimately this steady growth continued (with minor aberrations) for another five years until the pandemic recession.

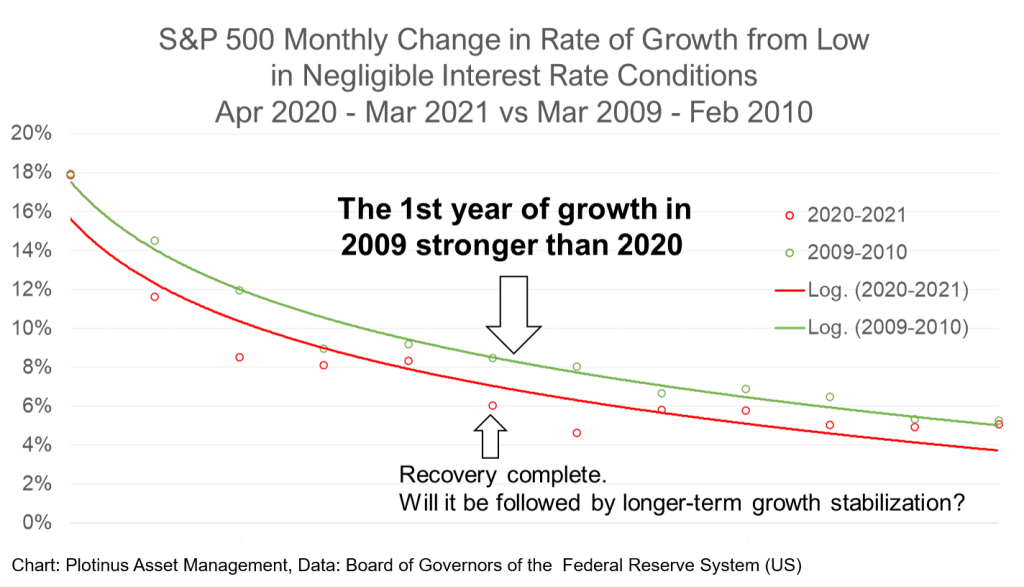

A similar pattern can be observed taking shape in the last year. Since recovery was achieved in August, the change in the rate of growth is showing signs of stabilizing.

From the long-term viewpoint, it is early days in this post recovery phase and too soon to prognosticate on what this may mean for future growth. That said, however, it should be kept in mind that whilst it may not be the best idea for the speculative investor to look for historical repetition, policymakers do look toward history with somewhat of a different eye. The book on the crisis and post-crisis management of the Global Financial Crisis was authored by the Fed. They have the scope to take the broader view on how the long-term pandemic post-crisis should be managed. Thus far the indications are that this approach will be watchful and calm.

In 2021 we have already seen investors jitters when it comes to inflationary worries and there is a certain inevitability that fears of over pricing, the potential for a correction or sector rotation will be the source of further market turmoil. This is where investors are perhaps best served by looking for those opportunities that allow volatility to be managed while keeping faith with US equities. ■

© 2021 Plotinus Asset Management. All rights reserved.

Unauthorized use and/or duplication of any material on this site without written permission is prohibited.

Image Credit: Pixelbliss at Adobe Stock.