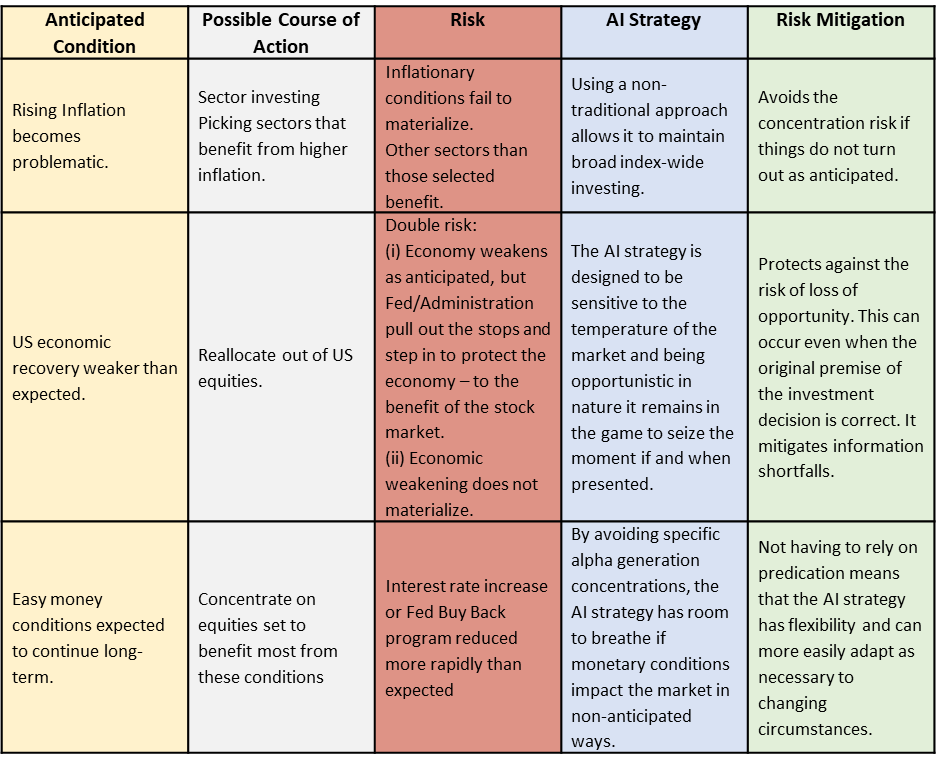

We were recently asked to explain how investing in an AI strategy might mitigate or alleviate some of the risks faced by investors as they attempt to appraise the various possible future outcomes for the US market based on economic indicators and market dynamics.

This is an interesting question from our perspective as our firm’s investment strategy uses artificial intelligence to provide the investor with an alternative way of accessing a better risk-adjusted return than a passive US index investment. We appreciate that generating a better risk-adjusted return requires side-stepping some of the trauma of drawdowns in order to achieve that objective.

So, what can differentiate an AI approach in this context? Let’s look at what the context is.

The US equity market has had a very positive first four months of the year (the S&P 500, for instance was up by 11.3% by the end of April). How should this be interpreted? Could there be more juice left in the tank for 2021? Those of bullish persuasion need only look to 2019 to garner some indications that there could be a further 20% appreciation yet to come. On the other hand, those of bearish persuasion see a correction on the horizon and a year-end that could easily be -10% from where it currently is, as well as a market that is potentially negative 12 months hence. Neither outcome can be dismissed as both are well within the bounds of possibility. The lack of consensus means that the commonality here is uncertainty.

Key Concerns in Today’s Market:

The March inflation rate of 2.6% is above the Federal Reserve’s target level of 2%. Should the inflationary conditions be a cause for concern?

The administration already has had to walk back on comments in the past week that suggested that the low interest rate conditions may need to be adapted in response to inflationary concerns. Is there a risk that the Fed will be spooked by inflation?

For how long will the easy money conditions (negligible interest rates and bond buy backs) continue?

What are the implications of the recent disappointing employment figures for April?

Does this suggest a weakness in the post-pandemic economic recovery?

The stock market’s interpretation was that this negative news on the economic front indicated more confidence in the continuance of the easy monetary conditions. Is this a well-placed belief for a long-term outlook or over-confident myopia?

These are just an illustration of the kinds of questions that investors are facing. In answering them, is sufficient cognizance being given by investors to the potential unusualness of our current market conditions? To what extent has the pandemic distorted the norms of investment decision making?

Achieving the correct response to this uncertainty is for the investor a delicate balance of both timing and selection.

Then there is the temptation to be active for activity’s sake. The dread for those who are actively managing their portfolios is the risk of humiliation by passive investment. The lessons of 2020 loom large. With the tumult of March last year bailing may have seemed to be the most sensible course of action; unless of course that decision subsequently resulted in the missing of the April surge. In the hubris of current uncertainty, will doing nothing once again prove to be a more profitable course of action (if you’ll pardon the pun)?

Of course, the problems with passive investment are well known: while it does act as an insulator against criticism in a down cycle (you can never do worse than the market to which the investment is indexed) it has a limited upside. You can only get market returns at market risk. It is the role of active management to seek to improve the investor’s risk/return equation.

.Taking the Pain Out of Uncertainty

A well-designed AI strategy should enable the investor to not need to guess what is going to happen. It is not necessary for investors to paint themselves into a corner by committing to either selection or time decisions based on a prediction of what is to come. Those running a well-designed AI strategy should be able to adopt a more broad-based, self-critical approach that is sensitive to the flux of market dynamics (as should their AI strategy implementation).

How might such an AI strategy take important factors into account, keep attuned to shifts in market dynamics and compute what course of action seems to offer the highest probability risk-adjusted return investment opportunity? While all that detail is a topic for another day, let’s today take a look at the ‘important factors’ piece of that puzzle and take into account the range of considerations of what the analytics of a well-designed AI investment methodology should analyze in order to guide the investor towards better informed investment decisions.

Plotinus’ AI Strategy

AI strategies, generally speaking, also have the advantage that they are not trapped within the framework of some of the more traditional systematic strategies. For instance, quantitative approaches in general did not perform well in 2020. The pandemic induced volatility evaporated trends leaving those who follow them in their wake.

For an AI strategy to help to mitigate an investor’s concerns over uncertainty today, it should have demonstrated its worth previously, such as through the turmoil of 2020.

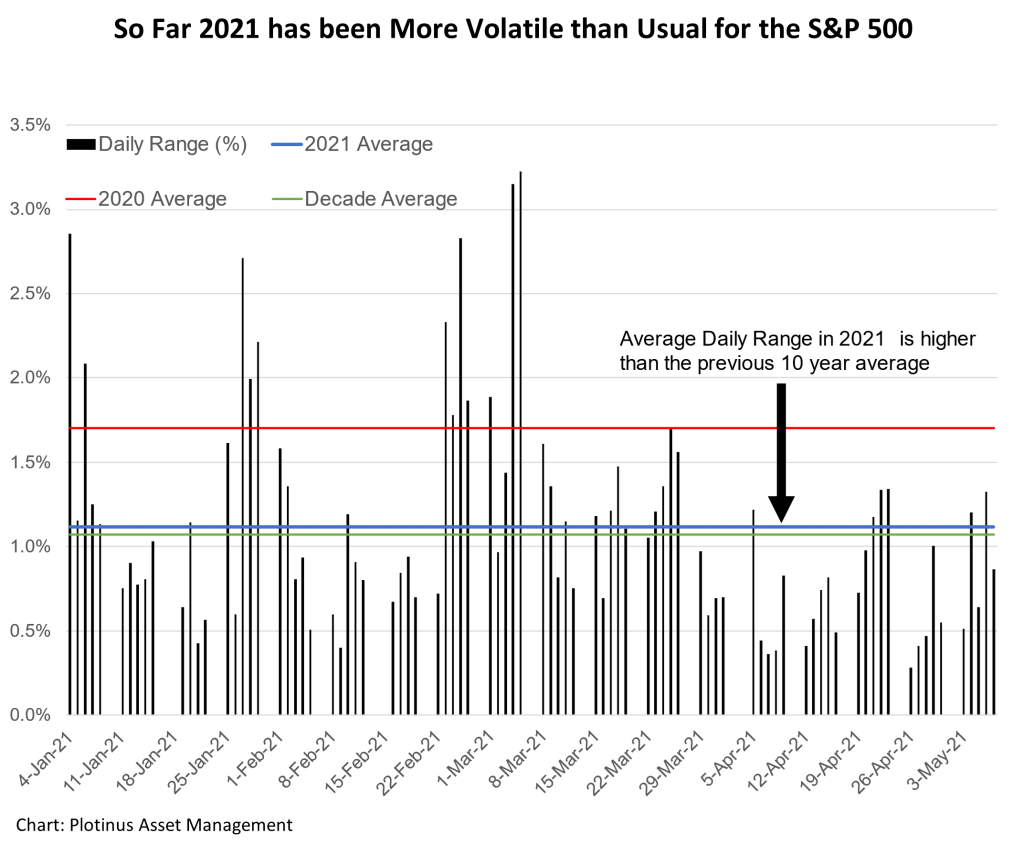

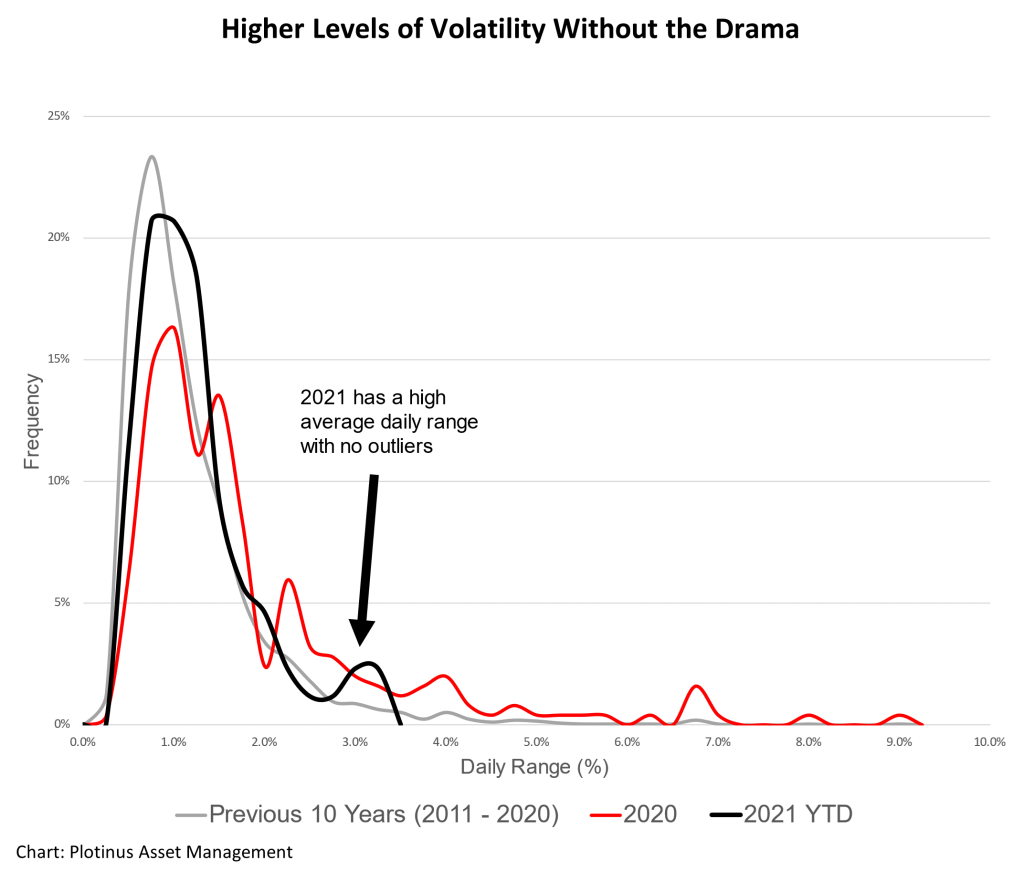

It is possible that there may be increased volatility on the way, as a by-product of increasing inflation scenario. If we look at the daily range for the S&P 500 this year it is a more volatile scenario than the average of the decade from 2011–2020.

Furthermore, although the S&P 500 is nowhere near as high as its average for last year, we must remember that thus far in 2021 (as we write this on May 10) we have had no days of wild volatility. The distribution chart [below] illustrates overall higher daily swings without the presence of the large outlier. Is this indicative of a post pandemic norm?

In such an environment the strength of a well-designed AI strategy over the alternative possibilities is that it offers the potential for a more tranquil route to the desired risk/return profile, without having to ‘over-read’ the tea leaves.

And along with adding the potential to generate good risk-adjusted returns, wouldn’t it also be nice to add a little more tranquility into your life? ■

© 2021 Plotinus Asset Management. All rights reserved.

Unauthorized use and/or duplication of any material on this site without written permission is prohibited.

Image Credit: Elenamani at Can Stock Photo.