Regardless of all the unknowns associated with war there is one absolute certainty, profound human suffering.

As is oft the case, conflict-at-a-remove, produces endless, expert speculation and prognostication on the current and future pattern of the war and its geopolitical and economic ramifications. So, rather than add to that speculative melee, with our take on the investment implications of the conflict, we would prefer to reflect on how the current Russian invasion of Ukraine has highlighted how fragile the interpretation of information can be.

To walk into a Café-Tabac not far from Paris on the second day of the war and overhear the customers’ discourse over coffee, on the comparative, potential impact of a contemporary Russian thermonuclear weapon vs the impact of the atomic bomb dropped on Hiroshima, is an anecdotal representation of a seismic and instantaneous attitudinal shift. Suddenly in the heart of Western Europe there had been a reversion to a vestige of the Cold War, a tangible, societal consciousness of nuclear war. Something had been turned back on as though someone had flicked a switch.

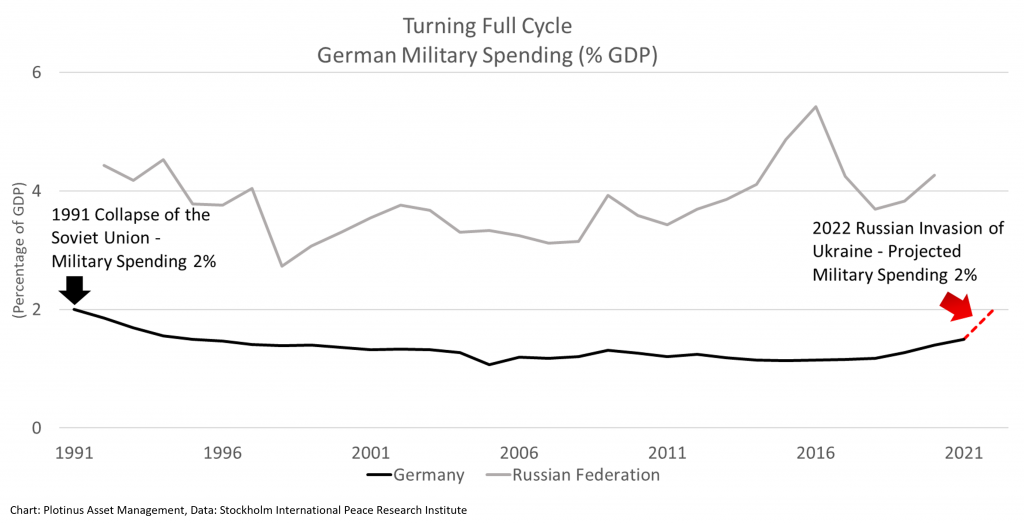

The implicit threat by Russia that escalation of the Ukrainian conflict equated with nuclear escalation, was quickly followed by Chancellor Olaf Scholz redefining German defense policy and promising to raise military spending beyond 2% for 2022, a level not seen since the collapse of the Soviet Union.

Information can be considered in different ways. It can, for example, be considered to be formed of interconnected layers based on certain chosen criteria. The intra-layer connections reflecting a stronger link than the inter-layer ones. In a simple version of this approach this can be thought of as an artist’s canvas, with each successive layer composing the picture. The invasion of Ukraine from an information perspective is akin to potentially being left without a canvas or perhaps realizing that the canvas one has is very different than the canvas one thought one had. Therefore, the validity of all the informational layers and accompanying understandings placed on it come under question.

Investment decisions have, over the past 30 years, grown to be based on a premise of an ‘information-canvas’ of an interconnected globalized economy, with the national entities placed along a spectrum of development. This is different from the Cold War era hegemonic world split into three.

Through its actions in Ukraine, Russia has shown its disregard for adherence to the rules of the globalized economy. The unprecedented sanctions in retaliation, are just that, unprecedented. They are not simply a response to the threat posed to Ukraine but to the entire post-Cold War order. If these sanctions fail to alter the path of Russian aggression, that is, if Russia can ignore, absorb, circumvent, or endure the economic consequences exacted on it. Then in addition to fulfilling its military objectives in Ukraine, Russia will have undermined the post-Cold War geopolitical and economic order and set the wheels of history turning once more, the very history that some thought ended with the fall of the Iron Curtain. ■

© 2022 Plotinus Asset Management. All rights reserved.

Unauthorized use and/or duplication of any material on this site without written permission is prohibited.

Image Credit: Gusty at Alamy Stock Photo.