The Russian invasion of Ukraine is the most profound challenge to date of the post-Cold War world order. With the looming specter of what an expanded conflagration might potentially mean, there has been a very heavy de-escalatory stance by the West, most specifically by NATO members, that would probably be best described as anti-brinksmanship. President Joe Biden’s pledge to defend “every inch of NATO territory” can be taken as the current, literal demarcation line, where threat will be met with threat. Until that line is reached, threat will be met with acceptance (sanctions, military support, and condemnation of humanitarian atrocities).

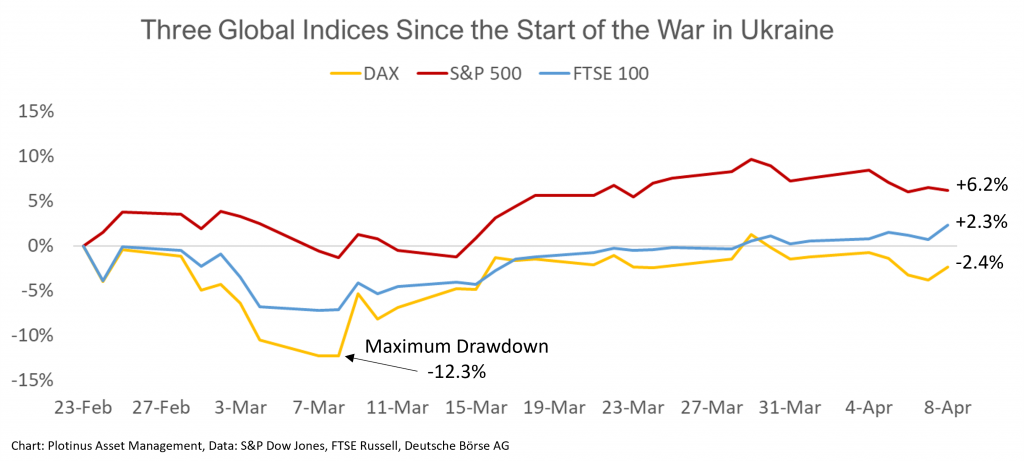

How does an investor take stock of this geopolitical upheaval? The global economy is clearly being affected by the conflict, but it is important to acknowledge that broad brushstroke inferences about those impacts are basically meaningless. The following chart illustrates the performance during the first six weeks of the conflict of comparative markets with decreasing proximity to the conflict in Ukraine: Germany, the UK and the US.

If stripped of context, the only market that really exhibits a significant disruptive event is the DAX, hitting -12.3% at a point. There is nothing unusual in the behavior of either the S&P 500 or the FTSE 100. For them, for want of a better phrase, it has been “business as usual.”

How do we comprehend the apparent disconnect between, facts on the ground and facts in the market, and the narrative of each? If only one of the chart’s performance lines matched the context of a geopolitical crisis (and by any political criteria the Russian invasion of Ukraine fits that definition). How do we discern the relevance of geopolitical concerns from an investment perspective? It is obvious that for Germany geographical proximity to the conflict, and significant economic relationships with the invader and invaded, explain why its markets are affected. Farther afield, however, those affects appear to quite quickly tend towards zero.

To make investment decisions based on geopolitical criteria is an artful specialization. It is not recommendable as an ad hoc investment strategy to insulate one from global turmoil where the inclination is to look for the overly simplistic, non-nuanced solution. For example, if asked six weeks ago, before the conflict began, Would a Russian invasion of Ukraine impact global markets, and if yes, would a risk-off approach be a recommended course of action? The sensible answer would seem to have been, Yes it would, and yes risk-off would be the correct approach. However, with the benefit of hindsight, for the three markets illustrated above, this would only have been the correct answer for an investor in the German market.

Markets are a very interesting amalgam of vested opinion, with the underlying premise for all participants being self-interest. All investment decisions are consequential for the participant and are entered into with the conviction that they are correct, regardless of whether or not that conviction ends up being proven to be right or wrong.

As proponents of artificial intelligence trade decision-making, we seek to determine actionable signals by distilling the information systematically from the market itself. We believe the market is the most relevant and rich source of information for those specific decisions. Information concerning geopolitics is no different, it too is rapidly embedded in the market, regardless of whether its effects are long-term and impactful or fleeting. This frames our understanding of how geopolitical events should shape our investment decisions—solely market-based and with fluidity.

Using AI to Make Better Informed Investment Decisions

It is important not to deceive oneself with the allure of geopolitical understandings and the temptation to make “sensible” investment decisions based on such “knowledge.” Having the correct geopolitical analysis does not necessarily mean that it can be translated simply into a parallel investment analysis. The future is an unknown, historical precedents are historical and investment decisions are speculative (uncertain). Better therefore to avoid prognostication based on “knowledge” (guessing) and ground one’s investment decisions on “fact” instead (while being aware of course that there really is no such thing as a “fact”—only information which is contextually based). The more an investor can understand the context for a decision, the more able they become to make better informed decisions, a process which can be assisted by artificial intelligence. ■

© 2022 Plotinus Asset Management. All rights reserved.

Unauthorized use and/or duplication of any material on this site without written permission is prohibited.

Image Credit: Attribution at Can Stock Photo.