Artificial intelligence having captured the investment world’s imagination is facing a crunch moment to prove its worth. Does it do what it claims it does, faster, better, more accurately etc. This is not an unfamiliar issue for us at Plotinus. It is one thing to innovate and create a different way of gaining trading insights by using AI, but ultimately the only relevant question is, does it work. To this end we will look Plotinus’ area of focus, short-term directionality in the futures market and compare it with some established short-term Managed Futures programs.

The Société Generale Short-Term Traders Index is a benchmark managed futures index comprised of a selection of the largest ten managed futures strategies defined as short-term, which means having an average holding time of less than ten days. To examine the validity of Plotinus’ AI Trade Decision-Making process we compared the Plotinus Non-Correlated Alpha Controlled Risk Program against the performance of eight of the managed futures programs represented in the SG Short-Term Traders Index (from January 2018 – August 2024). It should be noted that each of these programs are distinctive in their trading methodologies, but with a shared criteria – that of short-term trading, so this provides a good basis to review Plotinus’ AI’s ability to perform and also to see whether or not using this AI approach illustrates clearly different behavior than other short-term futures traders.

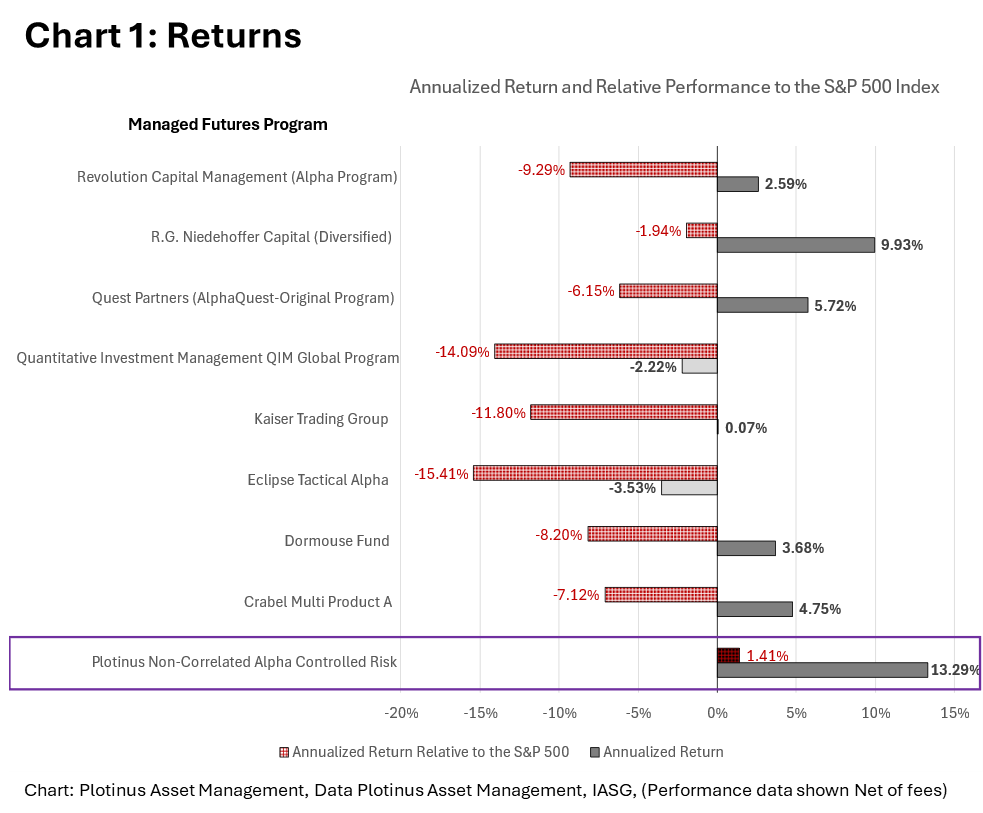

As can be seen in Chart 1, there is quite an array of returns across the eight programs, ranging from +9.93% for the R.G. Niederhoffer program to -3.53% for the Eclipse Tactical Alpha one. In this context Plotinus’ +13.29% is a significant outperformance. Taking a different measure of performance, annualized return relative to the S&P 500 return, one can see that none of the eight short-term trading programs outperform the US Equity benchmark. Plotinus on the other hand stands out as the only program to do so.

From the Risk Return Perspective

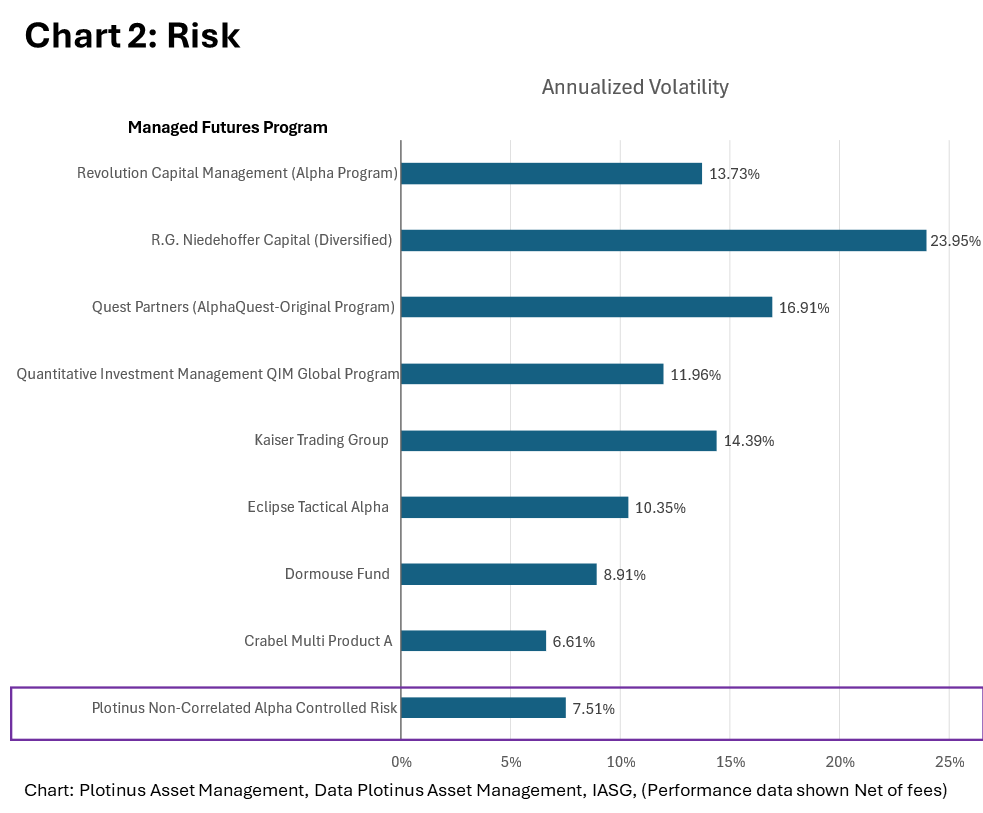

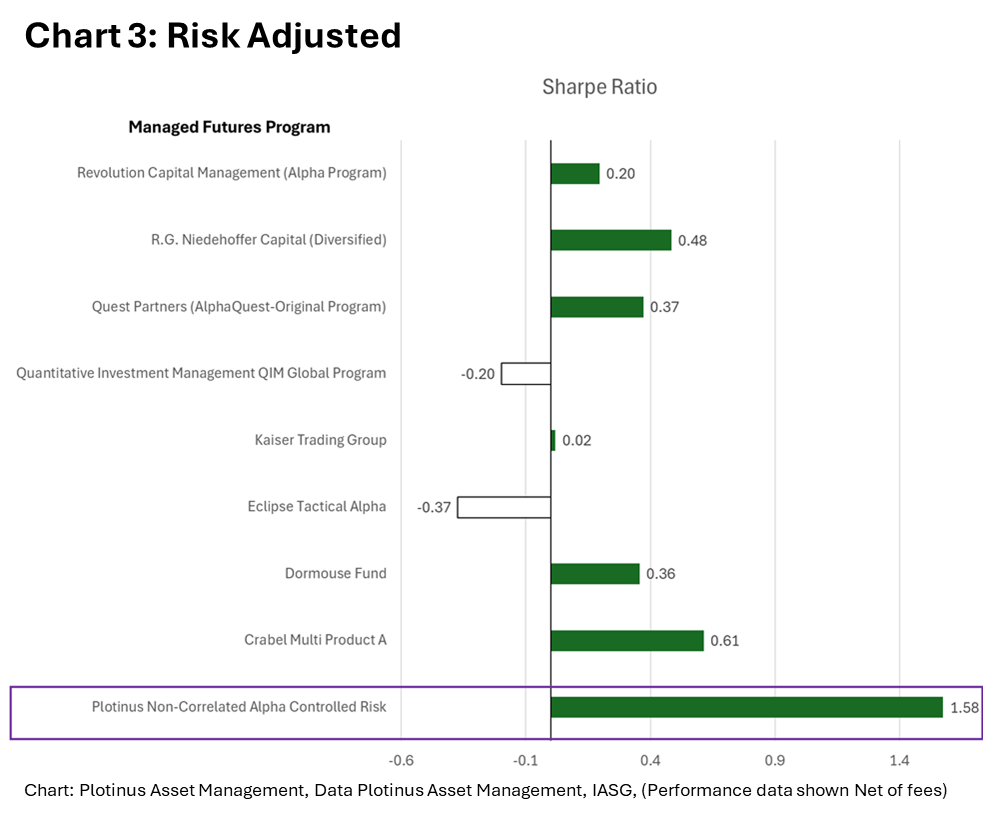

Looking at volatility in Chart 2 we see the difference between the various programs, with the Crabel Multi Product A having the lowest at 6.61%. The R.G. Niederhoffer program has the highest volatility of the group at 23.95%, interestingly this higher volatility is as noted previously, the highest returning program of the eight. The Plotinus program has the second lowest volatility at 7.51%. To explore the risk adjusted performance Chart 3 shows the Sharpe Ratio for the selection.

Here we can see that the Crabel program’s low volatility translates into the healthiest Sharpe ratio of the eight programs at 0.61. To put this in context the S&P 500 over the same period has a Sharpe ratio of 0.67. Once again, we can see that the Plotinus Non-Correlated Alpha Controlled Risk is considerably different, with a Sharpe of 1.58 that clearly outperforms the rest of the field.

Observing the Difference of AI Generated Short-Term Trading

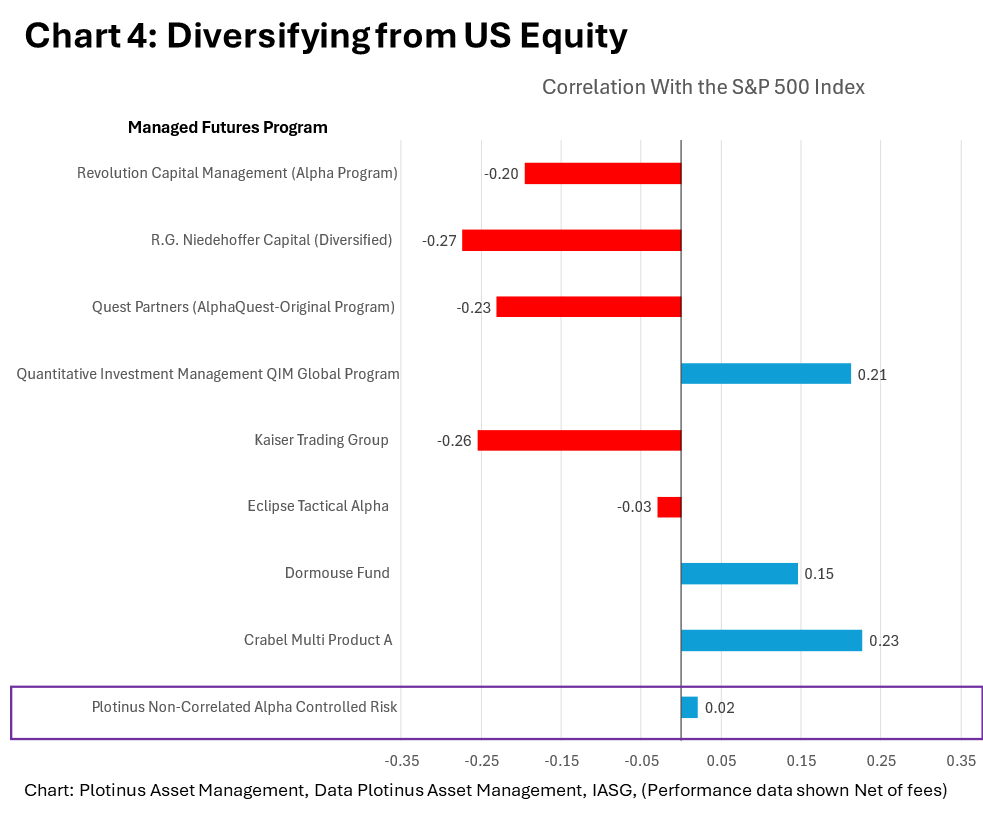

In Chart 4 and Chart 5 we look correlation. Firstly with respect to the S&P 500. We observe the low correlation of all the programs, and we also see the differences ranging from a -0.27 low anticorrelation for R.G. Niederhoffer to a +0.23 low positive correlation for the Crabel program. This low correlation is not surprising given the short-term nature of the trading. The Plotinus program has the lowest correlation of all at 0.02, this is in a similar region to the -0.03 of the Eclipse Tactical Alpha which is negligibly anti-correlated to the S&P 500. In the Eclipse program’s case however this low correlation to the S&P 500 is not translated into any meaningful advantage, when the other performance metrics are considered, as shown in Charts 1-3.

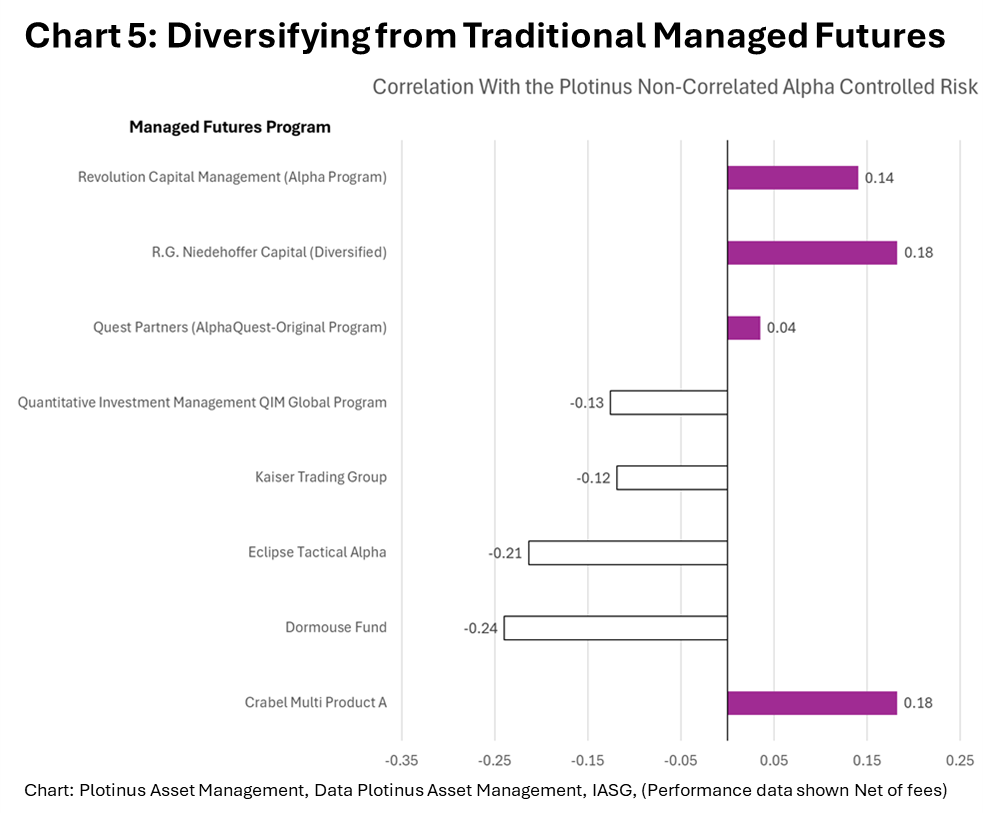

Next let us examine whether or not the Plotinus program exhibits a distinctiveness from the other strategies. Chart 5 illustrates the correlation between each of the eight programs and the Plotinus Non-Correlated Alpha Controlled Risk. As can be seen there is a range of low anti and positive correlations, from -0.24 to 0.18 this lack of substantive correlation indicates that the AI Trade Decision-Making approach is actually behaving differently than this selection of short-term trading approaches. From our perspective this is in a way to be expected, as the manner in which the Plotinus dynamic deep neural network analyses the data it receives and identifies tradable signals does not follow a conventional path.

We can conclude from this brief examination that Plotinus’ AI short-term trading is clearly doing something different than some of the leading short-term Managed Futures programs. Being able to offer that difference is what artificial intelligence should be doing – it should be providing insights which we otherwise would not have access to. In the context of investors looking for novel managed futures opportunities, Plotinus’ AI approach shows how a new way forward can be achieved. ■

© 2024 Plotinus Asset Management. All rights reserved.

Unauthorized use and/or duplication of any material on this site without written permission is prohibited.

Image shows Chicago skyline. Credit: Nick Fox at Shutterstock.