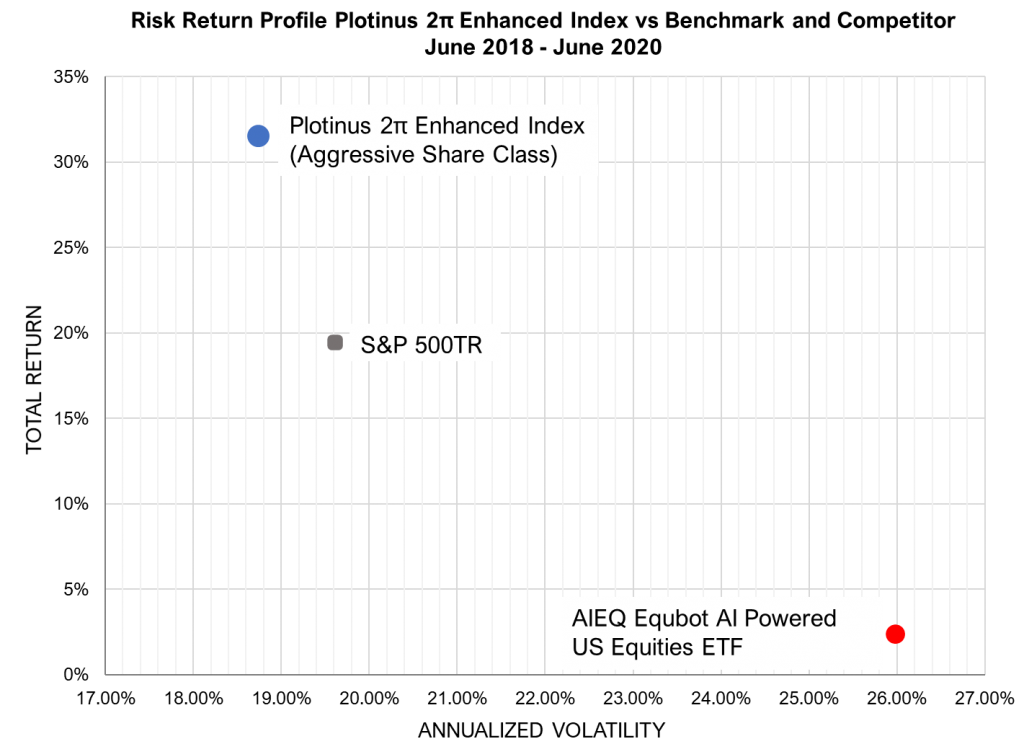

Plotinus has cause for celebration. In June, our firm entered into its third year of using AI decision-based trading. It has been very encouraging to see the power of our technology prove itself in US equities against both the market benchmark and the competition.

Chart: Plotinus Asset Management

It is perhaps a good point to reflect on the lessons learned as an artificial intelligence manager in reaching this point and how we envisage things going forward.

1. Be More Skeptical Than Your Most Skeptical Critic

Working with Artificial Intelligence may sound exciting and fashionable, but unlike other fields where there might be space to trial your technology, trading is intolerant.

Investors’ questions at the end of the day are very blunt. Does it make money? Does it beat its benchmark? Are there other additional latent, strategic benefits?

You may have great technology, but if you are not answering the above questions affirmatively, that technology is useless for the job it is supposed to do. In order to achieve success, you must be your most severe critic. You must force the technology to show its worth, to prove that it works from an investor’s perspective, not from a technologist’s.

2. Understand Error

This is a company mantra which I will gladly repeat ad infinitum.

Designing an AI trading system must begin by recognizing one’s own ignorance. It is what you do not know, do not yet know, or may never know that will bring about the failure of a system. Do not fall into the trap of fooling yourself that you know from the outset all the answers. Humility from the beginning is a good idea, you will see confidence grow, earning it as you progressively understand error. There is no value in concentrating on what works. What works never causes you any problems until it fails – that is when works becomes worked. Seek vulnerabilities, identify flaws, hammer your system, if there is anything left when you are done, then you really have a strong basis to work from.

3. Don’t Get Lost in the Jungle

Simply because you have the capability to do something does not automatically mean that doing it is a good idea. This is a common failure in developing technology. With the ease of using off the shelf technology, people are frequently overawed by their ability to accumulate and process infinite amounts of data. This approach fails to ask some fundamental “Why?” questions.

We have adopted a considered, bespoke approach to build from the ground up, including using inhouse generated derived data. This is to understand at all stages why you are developing the technology as you are. We call this Nimble AI with an emphasis on simplicity, to create task-based AI. We have found that this approach lends itself very well to decision-based trading systems.

4. Good Product is Key

It is vital to talk with and listen to investors to understand the problems for which they do not have a satisfactory solution. This is where you can use your technological development creatively, to build simple, elegant fit for purpose tools, to offer a product to those investors that provides them with a solution. Remember an investor wants an investible product that is relevant to their needs, not the latest technology for technology’s sake. An investor should not be expected to have to understand the technology, they should instead be offered the clear investment methodology and process that governs the use of that technology, that allows them to verify and measure performance in an easily understood manner.

5. Illustrate Your Distinctiveness

The active management industry is in decline. It is badly in need of an injection of new ideas and new thinking, but more importantly it needs to see the execution of those ideas and thinking. Active management needs things that work.

AI is a developing field that stems from a long, evolving pedigree. It is important for the creators of this technology using it in asset management to step up to the challenge. They have a responsibility to present the new and illustrate the distinctive, powerful advantages that AI can bring to investors. AI asset managers must have the future vision to see where and how they can continue develop both innovative products and technology.

Learning is a never-ending process. We look forward to growing our understanding and continuing to share the benefits of AI decision-based trading with investors in the years ahead as this area of asset management matures. ■

© 2020 Plotinus Asset Management LLC. All rights reserved.

Unauthorized use and/or duplication of any material on this site without written permission is prohibited.

Image Credit: Julie at Adobe Stock.