If AI does the equivalent of what older day tech companies did post-1995, consider where the growth is most likely to come from.

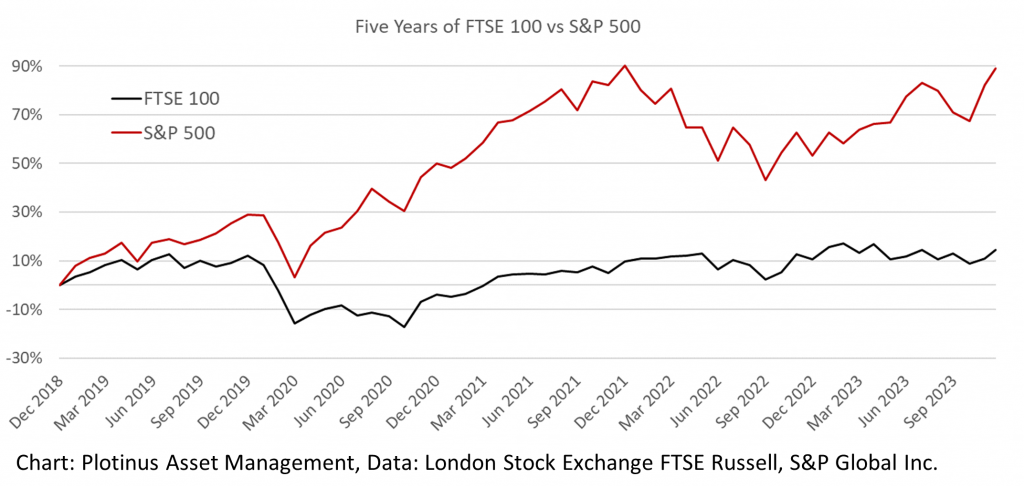

As we close 2023, the US stock markets have had yet another blistering year. Looking over a five-year window, last year is the only blemish, in a storming return where the S&P 500 has clocked in a cumulative return of +89% (as of time of writing, December 20). Then spare a thought for its fellow Anglo-Saxon free market across the pond, in the UK.

Over the same five-year period the FTSE 100 has gained a meager cumulative return of +14%. The difference between the two benchmark indices is starkly illustrated in the following chart.

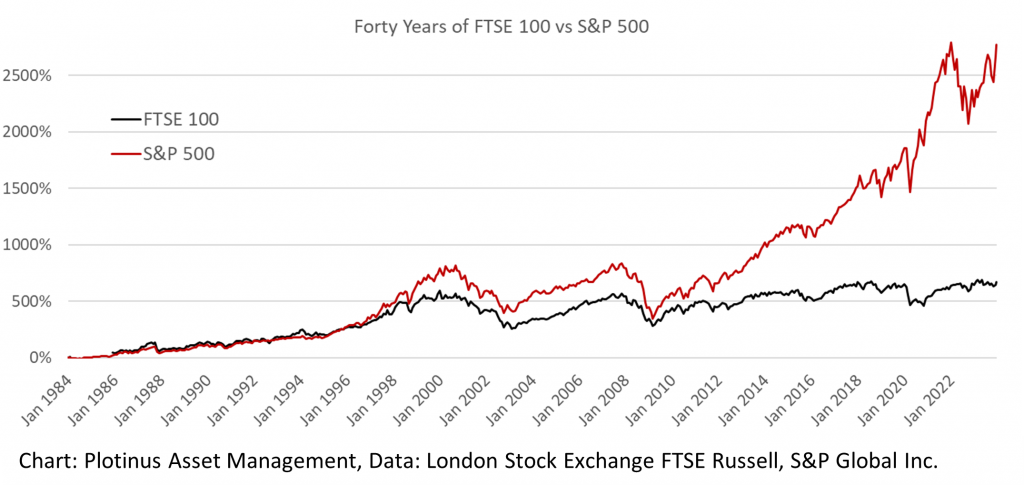

For market watchers this observation will be all too familiar. This performance malaise in the UK market versus the US began long ago, as the 40-year chart for both shows. The last time the FTSE 100 was cumulatively better than the S&P 500 was early in 1994. Since then, the UK index return has slightly more than tripled (x 3.3). The S&P, on the other hand, has increased by sixteen times (x 16.1).

From the period starting in 1984, one can see that in the first 10 years there is almost parity between both indices, however the separation begins in 1995. Although the shared contour is easy to see (both markets were similarly affected in the same cycles), beyond that similarity, over the next 25 years the S&P 500 has left the FTSE in the dust.

Let’s give pause to look again at that 1994 FTSE outperformance blip. Remember what plagued many US investors then? It was the yield curve inversion, which wreaked havoc on many a portfolio manager. In the fixed income world, over-levered mortgage derivative portfolio managers found mark-to-market pricing diverged for a time from the true value of some of those assets, threatening their survivability. In the more plain-vanilla US equity investing world, there were managers whose portfolios were top-heavy with interest-rate sensitive stocks and so took a tumble. Problematic times, but as the yield curve inversion corrected the US stock market regained its bearings. It has diverged from and outperformed the UK market since that time.

Missing an Era: “It’s Technical”

The UK market has clearly had less of a boom. The answer why is technical—well technological to be more precise; specifically, about the lack thereof. The UK stock market effectively missed the tech era. A glance at the constituents of both indices shows this plainly. There are still no tech companies today in the FTSE 100’s top ten companies by market capitalization, whereas eight out of the top ten in the S&P 500 are tech companies. In 1995 there also were no tech companies in the FTSE 100 top ten, while there were two in the S&P 500. It is this lack of fluidity among UK listed companies—a failure to move with the times—that has led to the shocking four-fold outperformance by the S&P 500 versus the FTSE 100 since 1995. Some of you might be wondering what the case would be if rather than the broader S&P 500 we took instead the DJI as the blue-chip index comparator for the FTSE 100. The relative performance over forty years is even worse than against the S&P 500.

UK Going For Safety And Regulation May Be The Loser’s Game

It appears that we could once again be at another era defining moment. The development of AI has the potential to create a wave of wealth for sophisticated investors who play it right in making concentrated company-specific bets. So too, to a smaller degree of investing success, for anyone passively invested in the US stock market—provided they can stomach the inevitable ups and downs of 18% annualized volatility.

But what about for the UK market? Back in London, British Prime Minister Rishi Sunak’s attempt to place the UK at the center of world AI governance is perhaps correctly recognizing there being an AI era moment that the UK needs to do something to get in on. The problem is, focusing on AI governance alone misses the point as to where the real wealth generation of that technology will ultimately lie.

The oddly constructed optics at the UK AI safety summit in November that had Sunak act as compere for a fireside chat with Elon Musk spoke volumes about where the power lay. All the leading governance in the world isn’t likely to alter the fact that Musk’s AI dollars will, as with most leading Western AI tech development, end up being reflected in the US stock market and not the UK’s. In fact, a charge towards further regulation is exactly what plays into established tech’s hands by raising the entry bar for innovation and driving that innovation into the pre-established stables of Silicon Valley.

Big Tech’s self interest in having AI regulated was something we at Plotinus noted in our March 2020 white paper: Redefining the Wall Street Cogito—Understanding the Growing Impact of Artificial Intelligence in Financial Markets.

If AI spawns for investors the equivalent of what older day tech companies did for them post-1995, consider where tomorrow’s growth is most likely to come from.

As AI adoption increases, including incorporation into some novel investment strategy methodologies, investors need to watch not where it is being used but where its value lies, so as to avail themselves of the best opportunities. Sometimes the value can be in a company improving operational efficiencies, sometimes in creating a new product, and sometimes it may be from developing some novel investment strategy methodologies.

In contrast to the post-1995 tech boom beginnings, a difference is investment performance on a company-specific basis in the public markets will likely occur across many sectors, and not be only in the tech sector.

Unless the UK shifts from its emphasis on how not to use AI and instead focuses on how to build and support successful UK-based AI companies, the talent behind AI and the corporate value it has the potential to generate will remain in the US.

For the institutional investors who are managing a pension fund, endowment, foundation or family office, this is something they can ill afford to ignore. ■

© 2023 Plotinus Asset Management. All rights reserved.

Unauthorized use and/or duplication of any material on this site without written permission is prohibited.

Image Credit: Dream_Light at Shutterstock.